TLDR

Market Recap: January 01, 2026

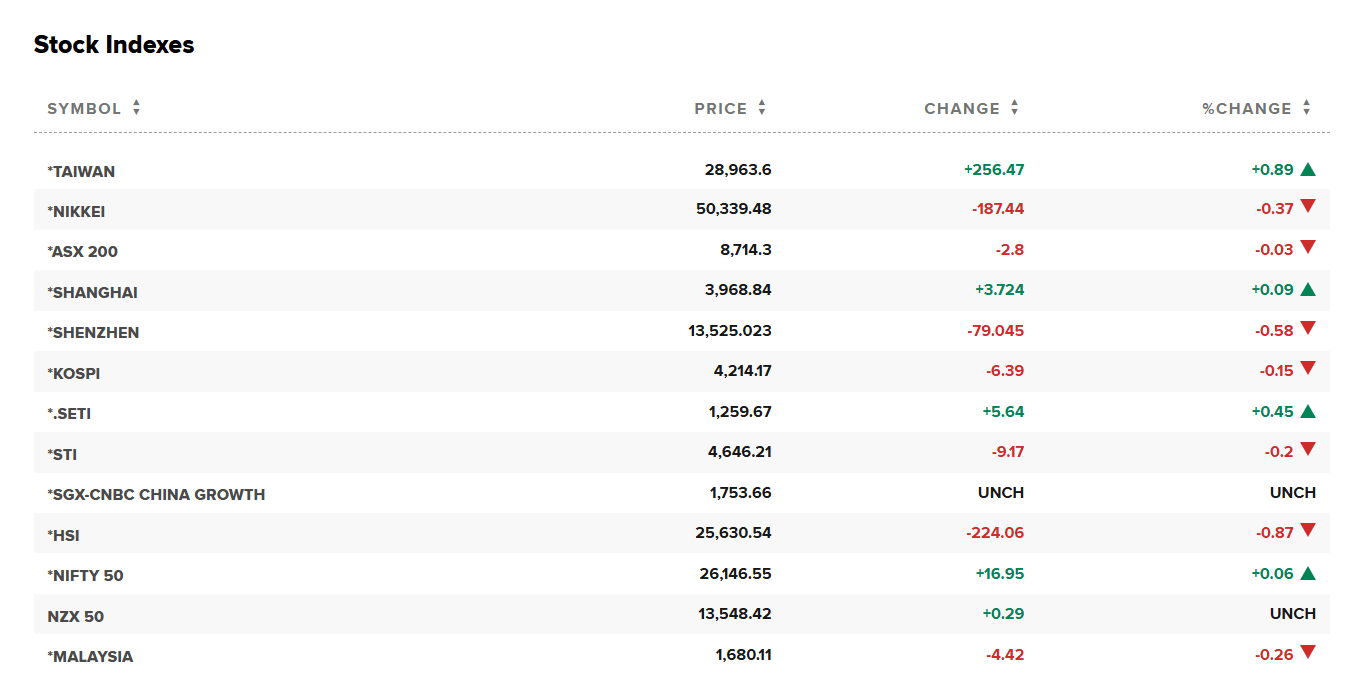

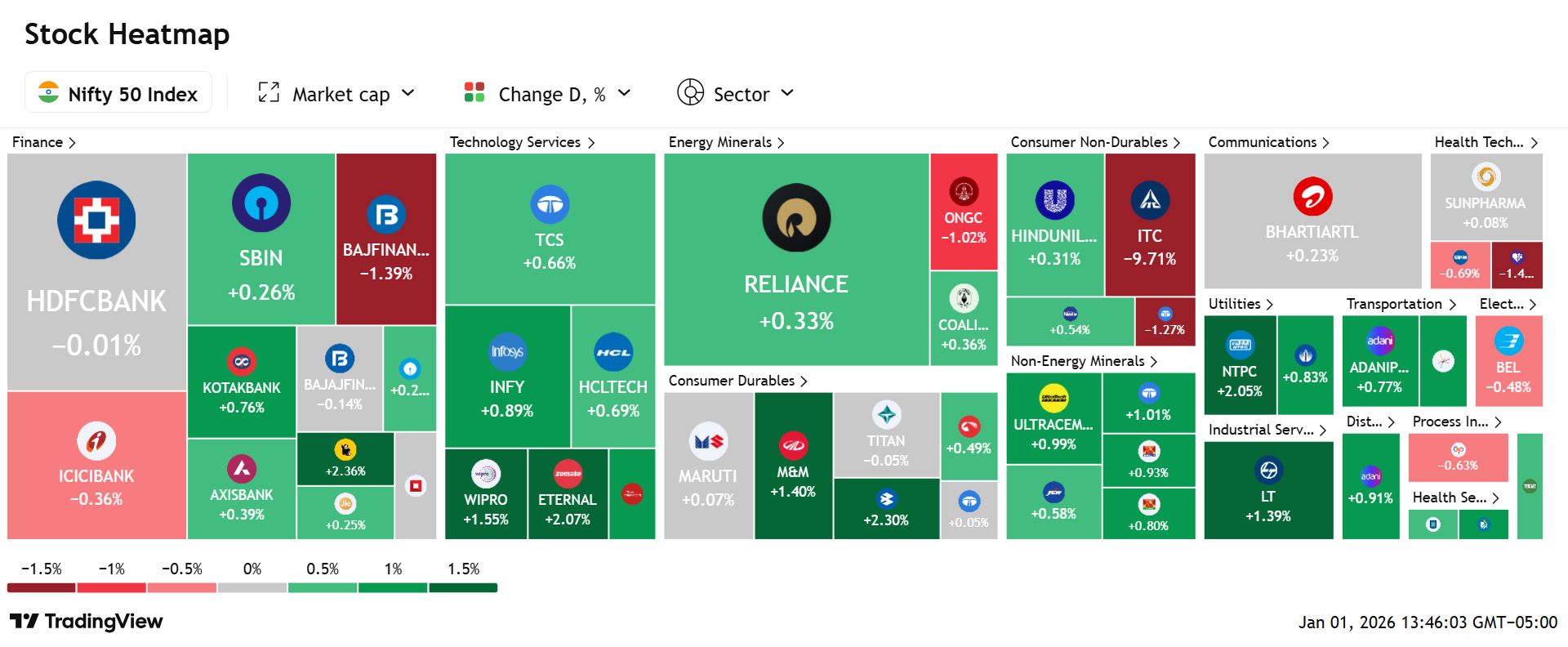

On January 01, Indian equities started 2026 flat-to-mixed in thin holiday volumes, with autos supporting while FMCG dragged after a cigarette excise-duty shock. Sensex closed at 85,188.60, down 32 (-0.04%), while Nifty 50 ended at 26,146.55, up 16.95 (+0.06%). Broader tone diverged with Midcaps up about 0.4% and Smallcaps down about 0.1%. India VIX cooled to 9.19, down 0.29 (-3.06%), keeping near-term risk pricing subdued.

Key Drivers :

Holiday tape: Thin global participation kept moves range-bound, with stock-specific headlines doing the heavy lifting.

Sector split: Auto strength offset a sharp FMCG cut; defensives lagged as pricing and regulation concerns resurfaced.

FX cue: Rupee began 2026 weaker on corporate dollar demand, keeping an eye on flows and forward-premium direction.

Today’s Top Stories:

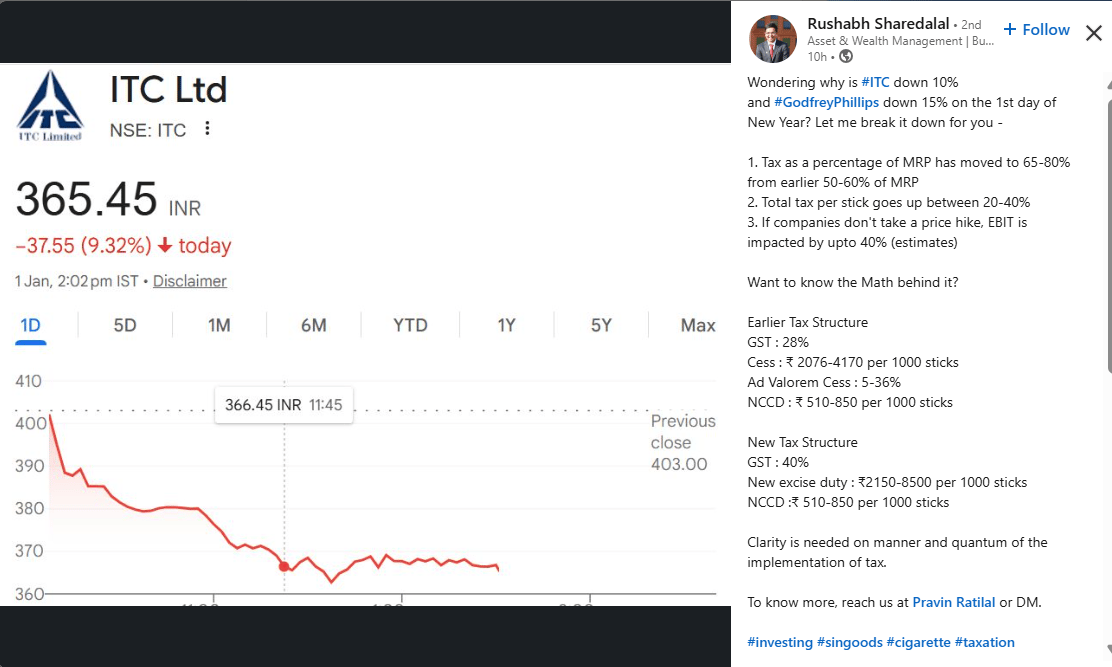

Cigarette tax shock: New excise duty hammered tobacco names, dragging FMCG and forcing price-hike math back into focus.

Autos lead: December dispatch strength plus earlier tax cuts kept autos bid, with Mahindra up and Ashok Leyland at a record.

Apollo order pop: ₹150 crore contract win lifted Apollo Micro as the defence order momentum stayed hot.

Piccadily rerates: Production start at the Chhattisgarh unit pushed the stock higher on commissioning clarity.

Rupee softer: Rupee ended at 89.97 as corporate dollar demand dominated a thin New Year session.

TOP STORIES

1. Cigarette excise duty hike hits tobacco

Gemini-2.5

Financial: New duty of ₹2,050 to ₹8,500 per 1,000 sticks by length adds cost on top of GST.

Strategic: Higher taxes risk volume pressure and a faster shift to illicit trade, forcing calibrated price hikes.

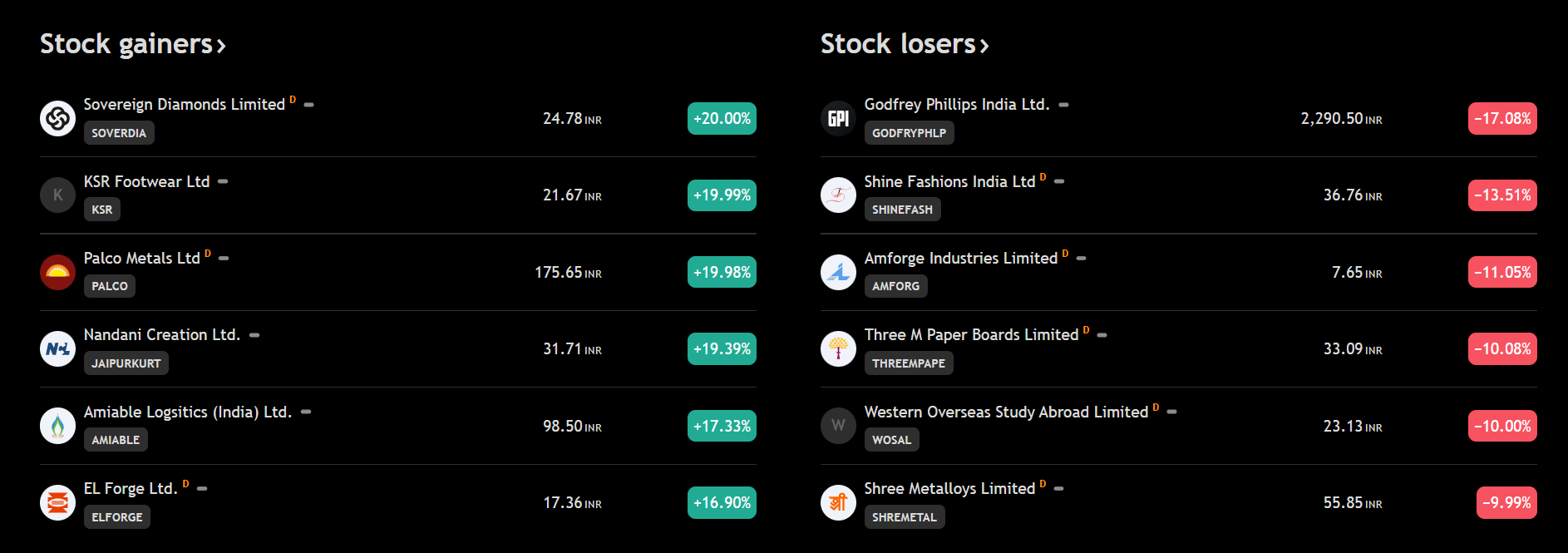

Market: ITC -9.7%, Godfrey Phillips -17.1%; the FMCG index took the hardest hit on the day.

Cigarette excise hike effective Feb 1. Market impact?

2. Auto dispatch strength lifts the pack

Gemini-2.5

Financial: Maruti small-car sales +50% to 92,929; domestic dealer sales +37% to record 178,646.

Strategic: Tax cuts, combined with SUV momentum, are reshaping the mix; Maruti flags a backlog and reviews pricing for entry models.

Market: Autos led sector gains; Mahindra +1.4%, Ashok Leyland +3.2% to a record high

Strong December dispatches. What’s next for autos?

3. Apollo Micro Systems: ₹150 cr contract via subsidiary

Gemini-2.5

Financial: Subsidiary signed a ₹150 crore execution contract with a private entity, per company filing.

Strategic: Adds to defense order momentum, improving near-term visibility and supporting the capacity-utilization narrative.

Market: Stock rose about 3% intraday as investors priced faster order-to-revenue conversion.

Apollo Micro wins ₹150 cr contract. Your take?

4. Piccadily Agro: commercial production starts at the new unit

Gemini-2.5

Financial: Company flagged production start at its Chhattisgarh facility, adding incremental capacity into FY26.

Strategic: Higher utilisation can support margins if pricing holds; execution cadence becomes the next checkpoint.

Market: Stock gained 6.8% on the day as the market rewarded commissioning visibility.

Piccadily starts production at new unit. Signal?

5. Rupee weakens near 90 on corporate dollar demand

Gemini-2.5

Financial: Rupee closed about 0.1% lower at 89.97, with price action constrained by thin holiday liquidity.

Strategic: 90 remains a psychological level; flows and any India-US trade progress stay key swing factors.

Market: FX tone keeps importers cautious and puts forward-premiums back on the early-January watchlist.

Rupee weakens toward 90. What drives next move?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.