TLDR

Market Recap: January 20, 2026

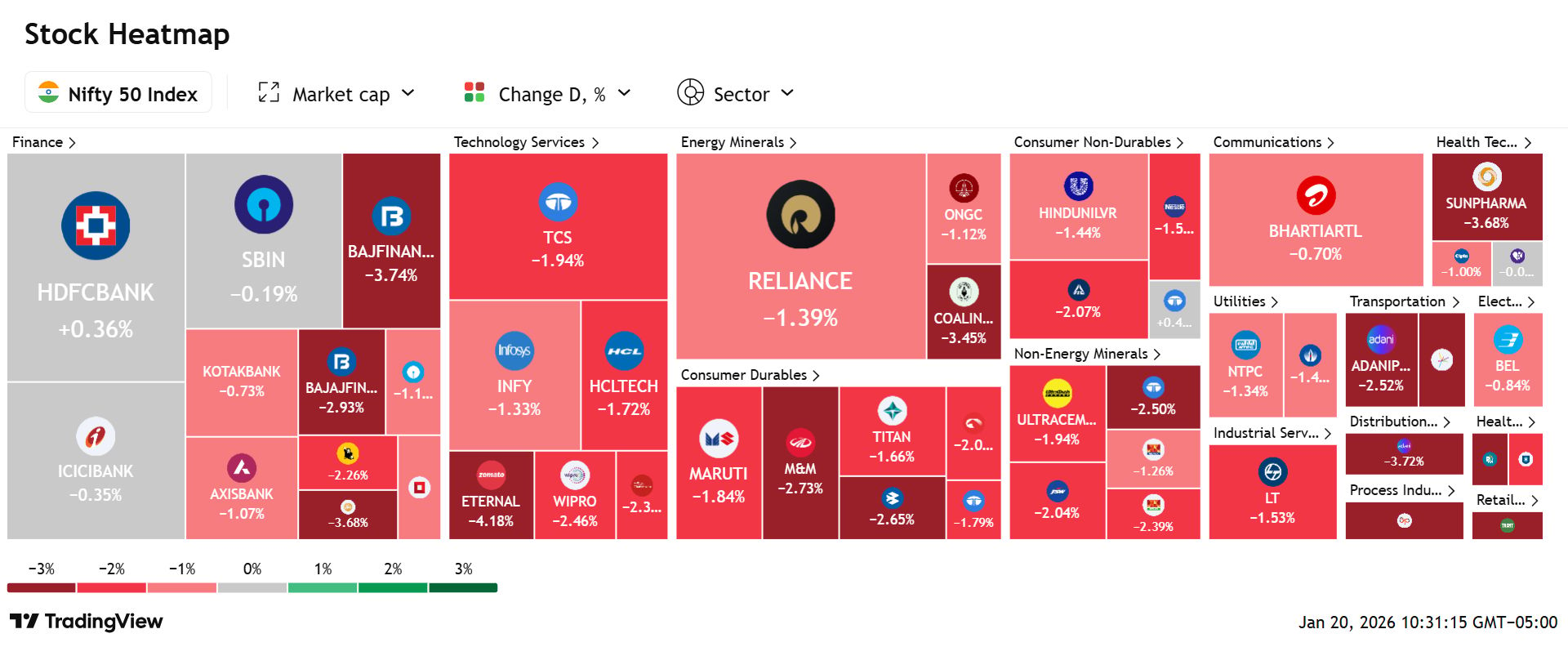

On January 20, Indian equities saw a broad risk-off unwind as fresh tariff anxiety, a weaker risk tone globally, and persistent foreign selling hit sentiment into earnings headlines. Sensex closed at 82,180.47 (down 1,065.71, -1.28%) and Nifty 50 at 25,232.50 (down 353.00, -1.38%). Broader markets took heavier damage: Nifty Midcap 100 ended at 58,053.65 (-2.67%) and Nifty Smallcap 100 at 16,703.40 (-2.83%). Volatility spiked with India VIX at 12.71 (+7.44%). FIIs stayed net sellers while DIIs absorbed supply (both provisional).

Key Drivers :

Tariff jitters back in focus: Global trade uncertainty resurfaced, pushing investors into de-risking and widening the selloff beyond large caps.

Foreign selling pressure: Provisional data showed FIIs as net sellers while DIIs bought, but breadth stayed ugly through the session.

Small/mid caps hit hardest: Broader indices fell nearly 3%, reflecting a fast unwind in high-beta positioning.

Today’s Top Stories:

LTIMindtree: One-time labour-code cost hit Q3 profit; stock sold off as margin visibility got marked down.

Sun Pharma: Non-binding Organon bid put mega M&A optionality on the table, along with leverage and integration risk.

Jio Platforms: IPO prep moved forward with lead bankers; valuation talk stayed front and centre.

Lodha: Signed MoU for major data-centre investment, reinforcing the developer pivot toward digital infrastructure.

ReNew: Looked at a $500m offshore bond via GIFT City, spotlighting funding runway and cost of capital.

TOP STORIES

1. LTIMindtree: One-Off Cost, Real Margin Shock

Gemini-2.5

Numbers: Q3 profit hit by a labour-code one-off; revenue held, but margins took the headline punch.

So what: Street now prices margin normalization speed, not “one-off” labels.

Market: Stock slid as confidence got repriced on earnings quality.

LTIMindtree takes a one-off cost hit, margins get pressured. Your read?

2. Sun Pharma: Organon Bid Puts Mega M&A Optionality on the Table

Gemini-2.5

Numbers: Non-binding offer for Organon surfaced; deal is exploratory, not committed.

So what: Upside is scale, downside is leverage and integration complexity.

Market: Optionality got noticed, but risk math stayed front and center.

Sun Pharma surfaces a non-binding Organon bid. What’s the right take?

3. Jio Platforms: IPO Machine Switches On, Top Bankers Named

Gemini-2.5

Numbers: Lead banker shortlist headline hit; IPO preparation narrative moved another step forward.

So what: Listing could reset platform-tech comps and crystallize value.

Market: Chatter supported sentiment even as the tape stayed risk-off.

$RELIANCE.NSE ( ▲ 3.61% )

Jio Platforms IPO prep moves ahead with lead bankers named. Your stance?

4. Lodha: Data Centre MoU Signals a Massive Digital Infra Push

Gemini-2.5

Numbers: Maharashtra MoU for a very large data-centre investment plan.

So what: Big capex bet, long-duration returns, execution milestones will matter most.

Market: Realty was weak, but the infra pivot stayed a key theme.

Lodha signs a major data-centre MoU with Maharashtra. What matters most?

5. ReNew: $500m GIFT City Bond Plan Puts Cost of Capital in Focus

Gemini-2.5

Numbers: Exploring a dollar bond via the GIFT City route to raise about $500m.

So what: Pricing, covenants, and hedging discipline decide whether this strengthens the runway.

Market: In risk-off tapes, funding access itself becomes a signal.

ReNew explores a $500m dollar bond via GIFT City. Your view?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.