TLDR

Market Recap: September 11, 2025

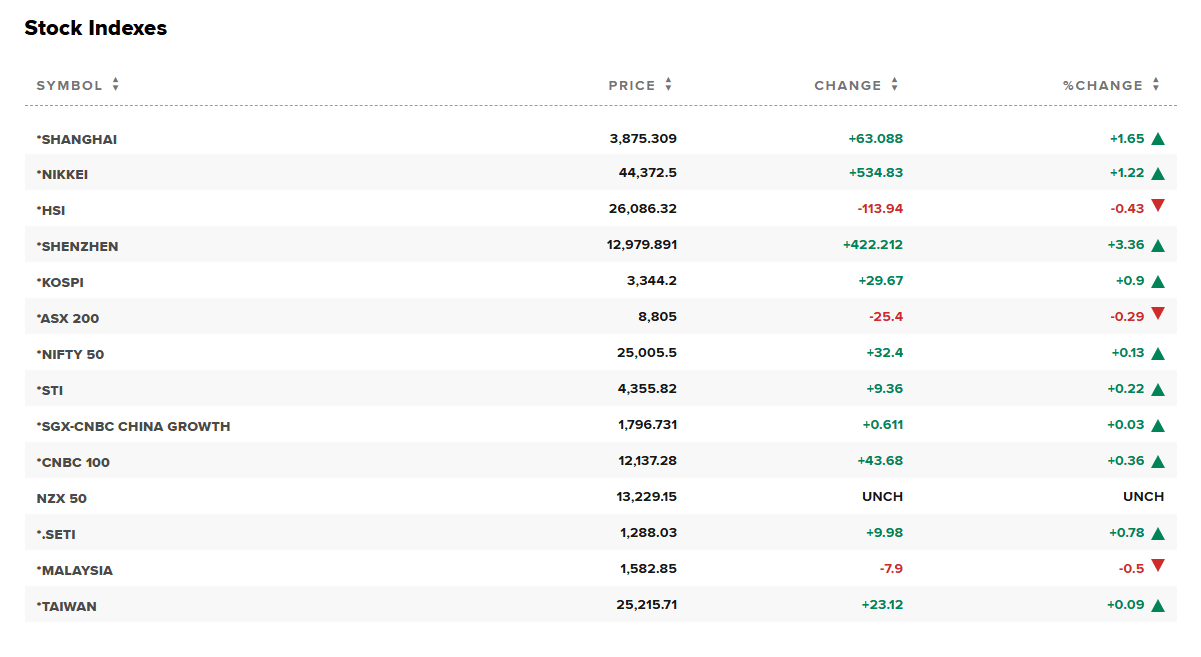

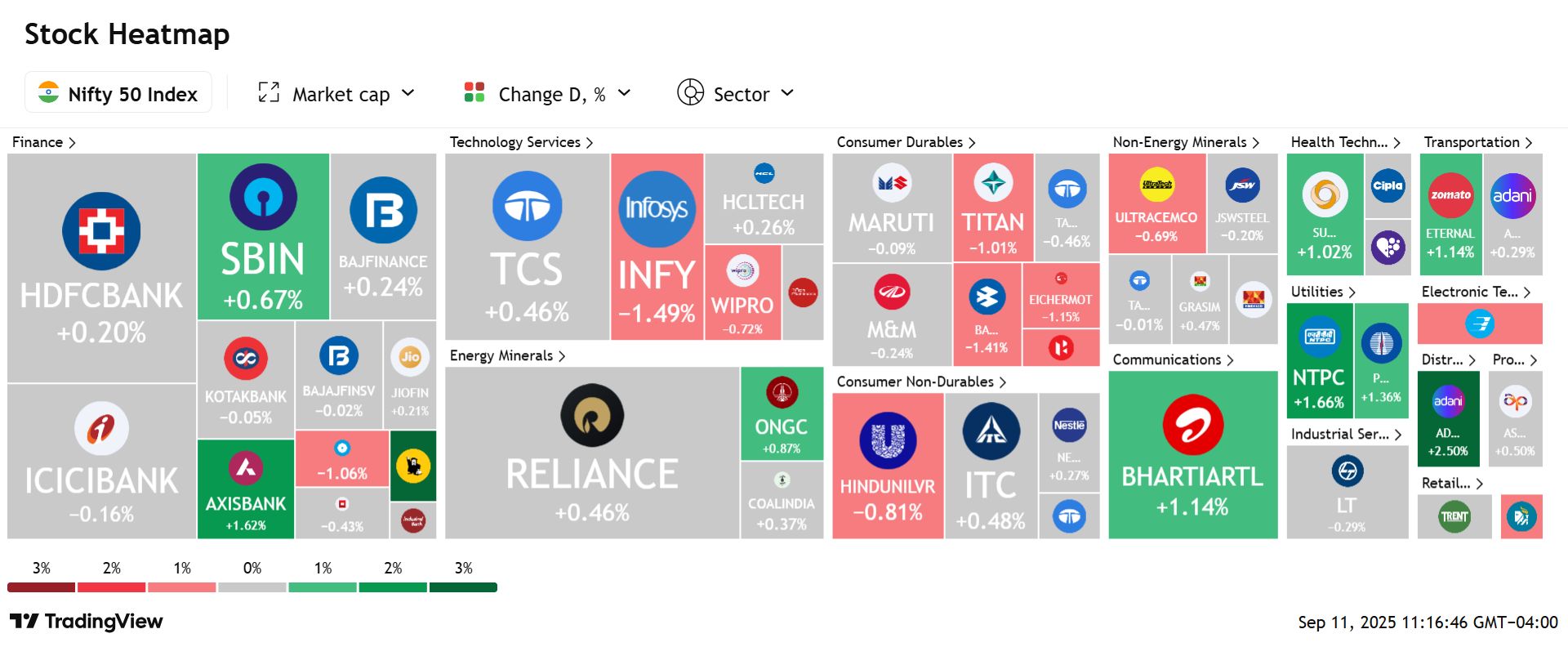

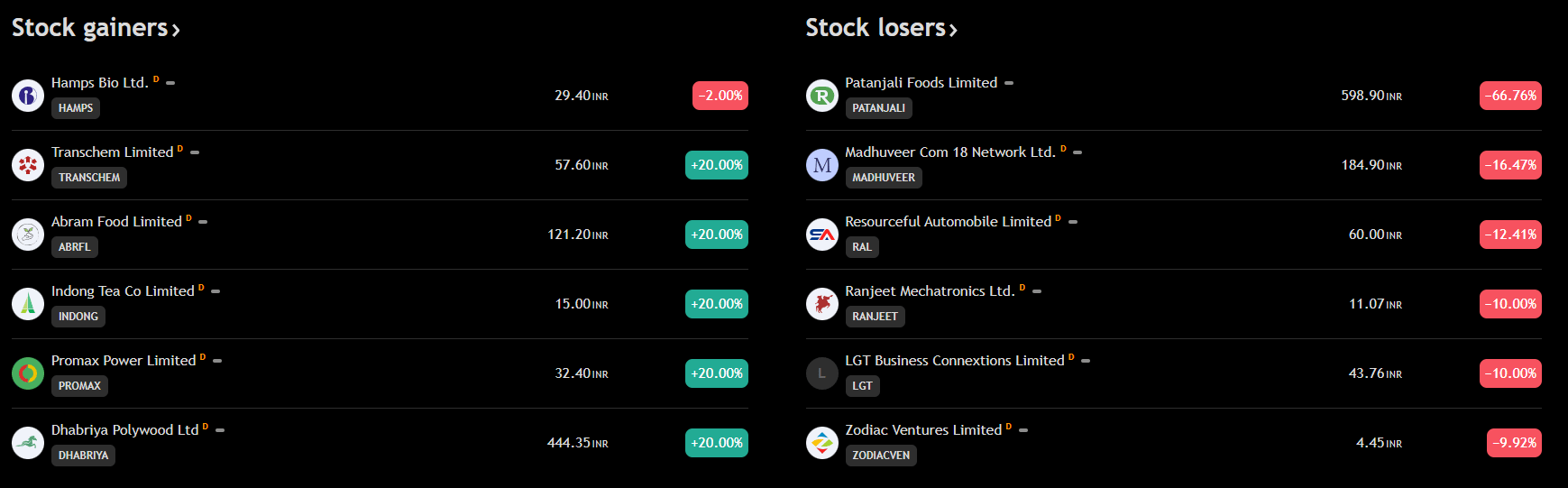

On September 11, 2025, Indian equity markets extended their winning streak on Thursday, closing positively amid resilient global cues, stabilization of institutional flows, and robust sectoral moves in oil & gas and banking stocks. The BSE Sensex closed at 81,548.73, up by 123.58 points (+0.15%), while the NSE Nifty 50 climbed to 25,005.50, rising by 32.40 points (+0.13%). Nifty Midcap 100 and Smallcap 100 ended broadly flat, reflecting limited profit-taking in the broader market. The India VIX fell to 10.36, hitting a 17-month low and indicating calmer market sentiment

Key Drivers :

Global Tapering Anxiety Eases: Optimism over renewed US-India trade discussions, coupled with hopes of a US Fed rate cut, supported sentiment, offsetting earlier worries over US tariffs.

FIIs/DIIs Flows Stabilize: Both foreign and domestic institutional investors turned net buyers, reducing volatility in large-caps and providing a floor to the market.

Sector Rotation into Oil & Gas, Banking: Energy, PSU Banks, and Power Stocks Led Sectoral Gains, While IT and Autos Saw Modest Profit Booking as Investors Realigned Portfolios to Perceived Domestic Strengths.

Today’s Top Stories:

Urban Company IPO Oversubscribed 9x On Day 2: Retail/NII bids drove demand; GMP points to strong debut; listing Sep 17.

SEBI Weekly Derivatives Rethink Hits Brokers: Consultation on ending weekly expiries weighed on BSE/Angel One intraday.

NTPC Upgraded to Buy; Shares Surge: HSBC upgrades NTPC, citing battery and nuclear push, driving shares up 2% to top the Sensex gainers.

Tega To Acquire Molycop For $1.5 Billion With Apollo: Scale and global reach up; shares softer on funding overhang.

Nomura Starts GAIL At ‘Buy’ With ₹225 TP: Brokerage cites tariff tailwinds and petchem recovery; stock outperformed.

TOP STORIES

1. Urban Company IPO Oversubscribed 9x On Day 2

DALL-E

Financial development: The ₹1,900 crore IPO was subscribed 9x by Day 2 (as of 17:00 IST). Retail 17.68x, NII 18.22x, QIB 1.48x, employee 13.45x; price band ₹98–103; anchors raised ₹853.87 cr earlier. Listing slated Sep 17.

Strategic implication: Strong retail/NII demand underscores appetite for scaled consumer-tech platforms; proceeds support growth and platform investments.

Market reaction: Not listed yet; grey-market premium ~34% indicates expectations of a firm debut (unofficial indicator).

Urban Company IPO is 9x subscribed by Day 2 (retail 17.7x, price band ₹98–103, GMP ~34%). What’s your call?

2. SEBI Weekly Derivatives Rethink Hits Brokers

DALL-E

Regulatory development: SEBI is preparing a consultation on extending option tenors and potentially replacing weekly expiries, following tighter intraday position caps.

Strategic implication: Lower weekly options intensity could temper retail speculation, impacting broker/exchange revenue mix while improving market stability.

Market reaction: BSE and Angel One fell 3–5% intraday on reform reports.

SEBI is weighing changes to weekly expiries and tighter intraday limits. Net impact on the market?

3. NTPC Surges After HSBC Upgrade; Push on Nuclear, Battery Storage

DALL-E

Financial performance: NTPC rose 2% to ₹333.50 after HSBC upgraded the stock to ‘Buy,’ citing its strong capex plans and leadership in power generation.

Strategic/operational implication: HSBC highlighted NTPC’s expansion into battery storage and nuclear power as drivers, with visibility on regulated returns from ₹7 lakh crore planned investment by 2032.

Market impact: The scrip outperformed BSE peers, emerging as the top gainer on Sensex, with positive broker commentary driving fresh inflows.

NTPC up ~2% after an upgrade, with nuclear and battery storage plans and large capex visibility. Your stance now?

4. Tega To Acquire Molycop For $1.5 Billion With Apollo

DALL-E

Deal details: Tega and Apollo-managed funds agreed to acquire Molycop at $1.5bn EV, giving Tega ~77% control; combined revenue ~$1.7bn, EBITDA ~$217m.

Strategic implication: Builds a scaled global mining-consumables player with broader footprint and product depth.

Market reaction: Shares eased on funding/dilution overhang despite strategic rationale.

Tega to buy Molycop at $1.5bn EV, taking ~77% control; stock down ~2.6%. How do you read it?

5. Nomura initiates ‘Buy’ on GAIL; stock outperforms

DALL-E

Financial development: Nomura assumed coverage with ‘Buy’ and ₹225 TP, citing an earnings uplift from potential pipeline tariff hikes and a medium-term petchem recovery.

Strategic implication: Brokerage sees regulated returns and downstream normalization underpinning multi-year cash flows, supporting capex and dividends.

Market reaction: GAIL gained ~3% intraday; closed up ~2.9% at ₹178.95.

Nomura starts GAIL at ‘Buy’ with ₹225 TP on tariff and petchem recovery; stock up ~2.9%. Your call?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.