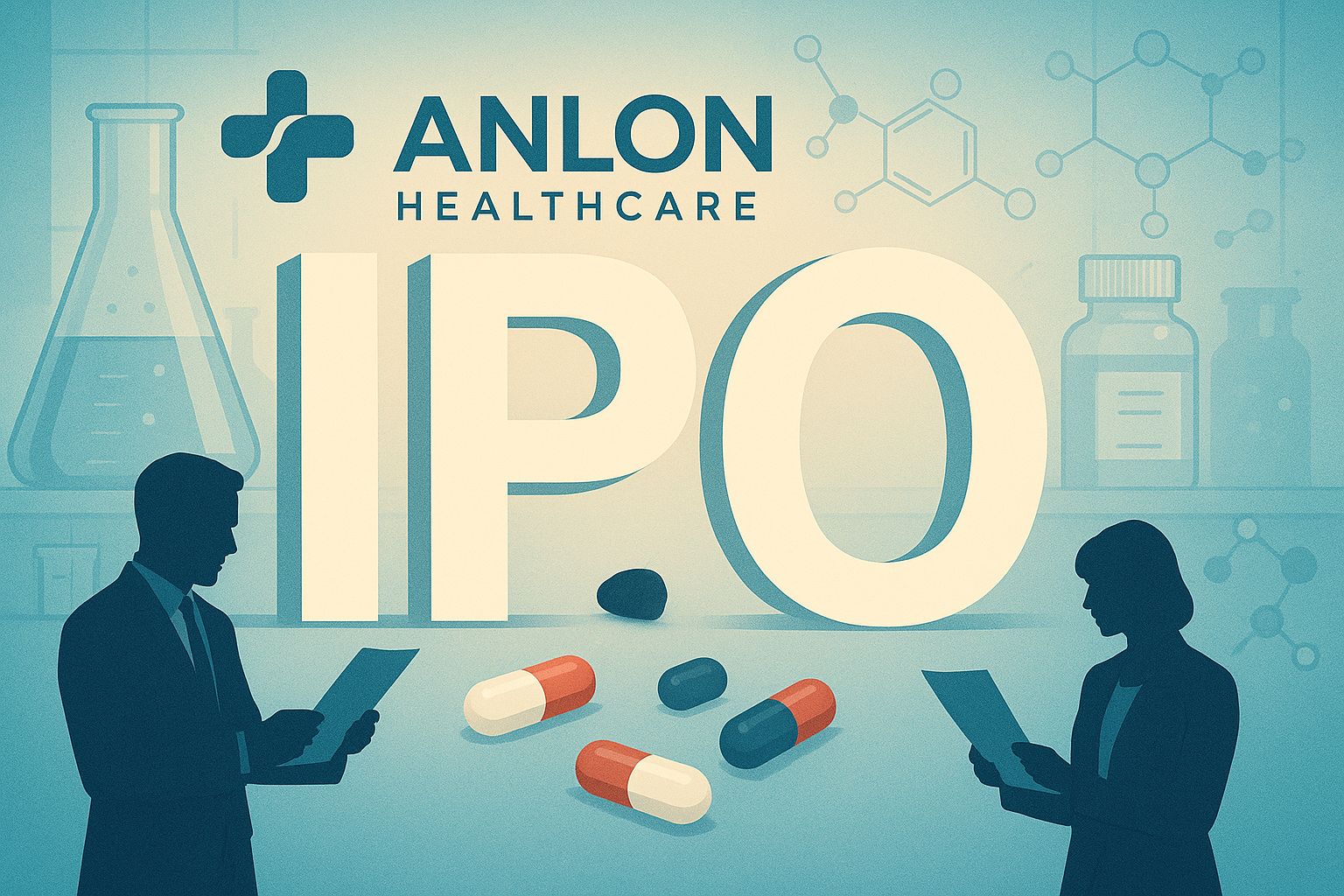

TLDR

Market Recap: August 28, 2025

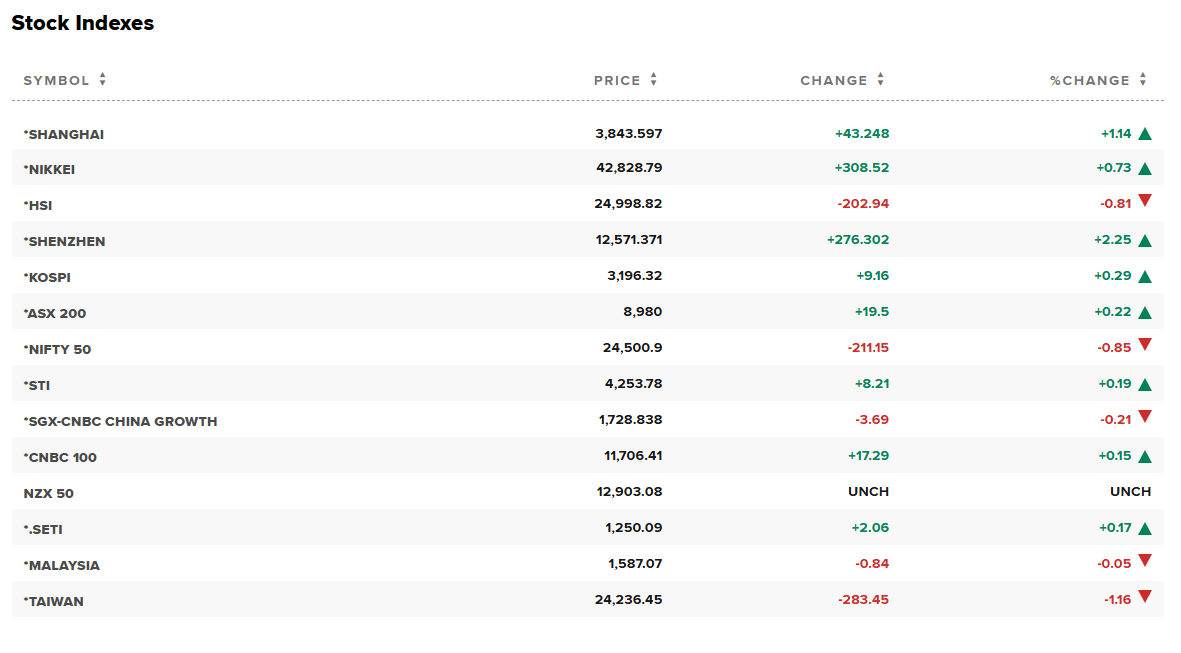

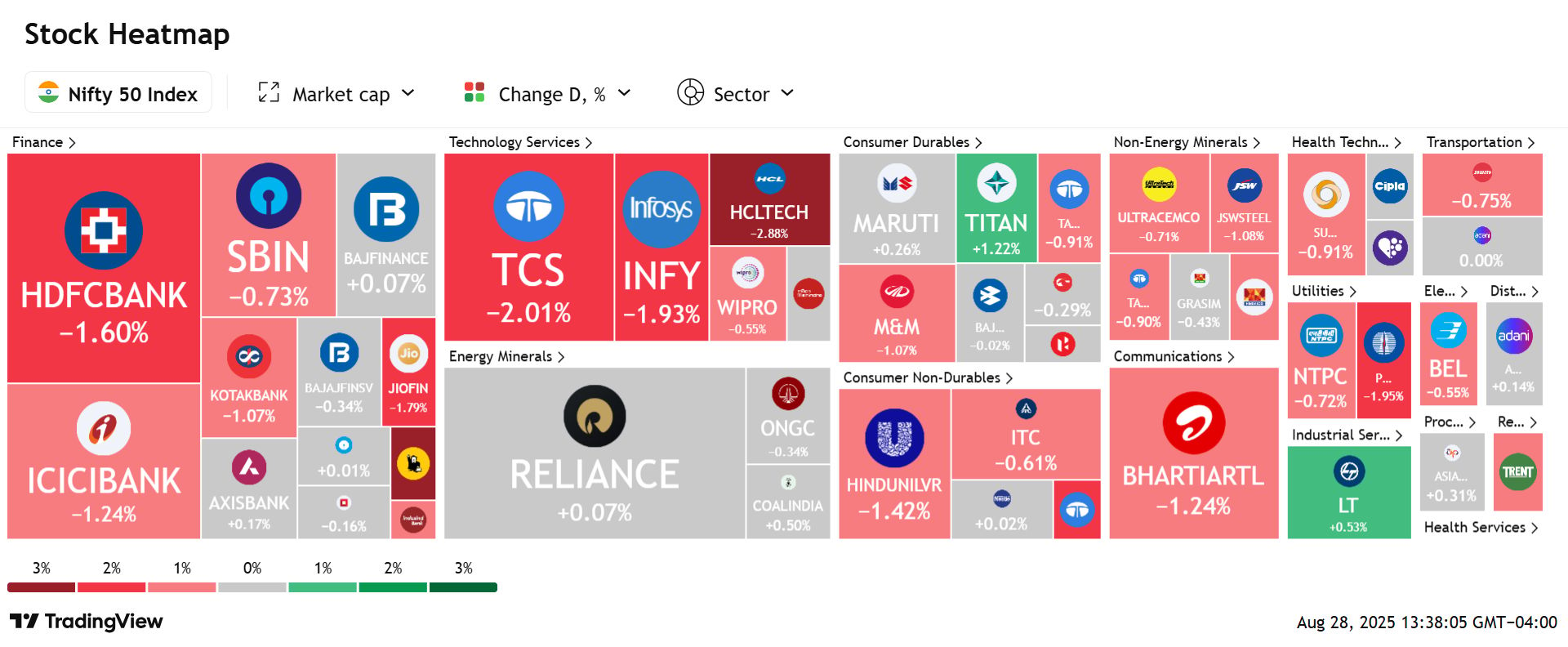

On August 28, 2025, Indian equity markets plunged with the BSE Sensex closing down 705.97 points at 80,080.57 and the NSE Nifty 50 falling 211.15 points to 24,500.90. Broad-based selling was triggered by new US tariffs and global risk-off sentiment, causing a sharp decline across all sectors.

Key Drivers :

US Tariffs: Newly imposed 50% tariffs by the United States on Indian exports sparked immediate market anxiety and sell-offs.

Global Cues: Weak global markets intensified risk aversion, prompting investors to turn defensive.

Sectoral Performance: Major declines in IT, banking, and realty stocks dragged the benchmarks lower.

Institutional Selling: Heavy outflows and cautious trading further fueled the rout in market capitalization.

Today’s Top Stories:

Trump’s Steep Tariffs Trigger Market Rout: Sensex tumbled 706 points and Nifty fell 211 as the US imposed 50% tariffs; risk aversion dominates, caution expected to linger.

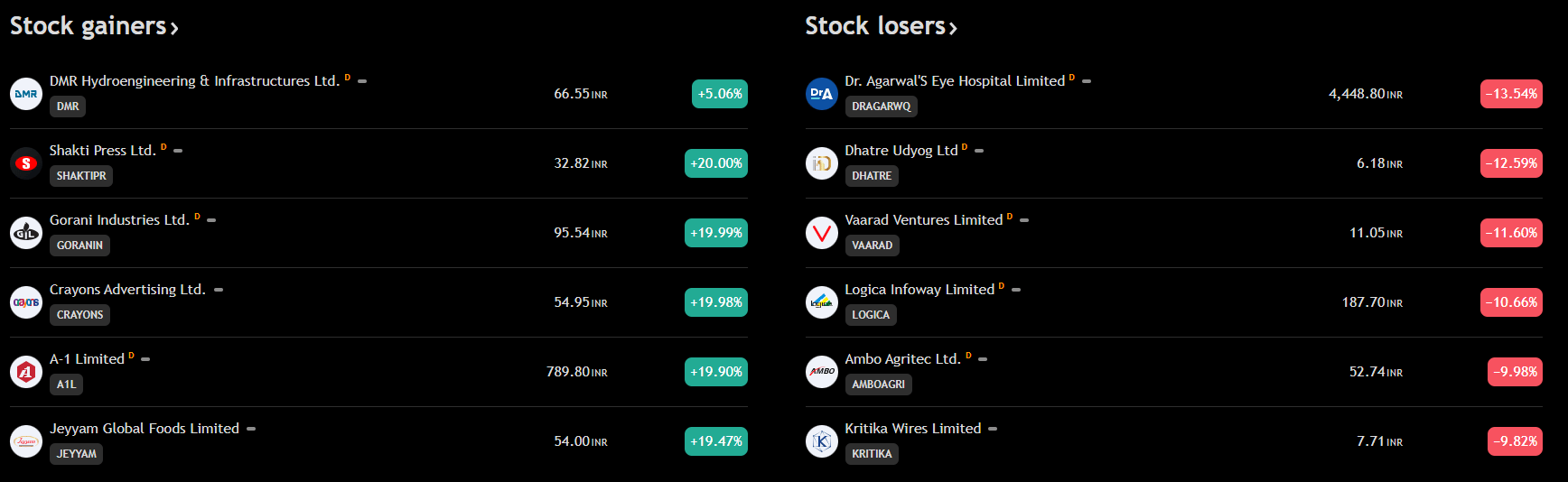

Ola Electric Defies Market Weakness: Ola Electric shares rallied 11%, setting a five-month high amid strong volumes despite market declines.

Infosys Partners With Mastercard for Global Payments: Infosys announced a new Mastercard partnership to expand secure cross-border payment solutions globally.

Vardhman Textiles Surges 13% on Cotton Duty Exemption: Vardhman Textiles rose 13% as cotton import duty exemption boosts textile sector sentiment.

Anlon Healthcare IPO Draws Investor Interest: Anlon Healthcare’s IPO launch sees strong investor appetite amid pharma sector listing momentum

TOP STORIES

1. Trump’s 50% Tariffs Shake Markets

DALL-E

Impact: Indian equities plunged, with the Sensex dropping approximately 706 points and the Nifty falling about 211 points in a single session.

Background: The steep 50% tariffs imposed by the United States on key Indian exports led to sudden risk aversion and broad-based selling by both institutional and retail investors.

Outlook: Cautious market sentiment is likely to persist unless there is diplomatic progress or a rollback of tariffs, which will keep volatility elevated.

Extra 25% duty from Aug 27 with some lines up to 50% total tariff. Your take on the tariff shock?

2. Ola Electric Rallies 11% in Weak Market

DALL-E

Share movement: Ola Electric Mobility hit a five-month high of ₹56.20, rallying 11% intraday even as the broader market fell.

Business drivers: Heavy volumes and bullish analyst commentary, with profitability expected to improve after Gen 3 scooter PLI certification.

Market outlook: Continued price strength and positive technical signals make the stock a rare bright spot amid broad declines.

Five-month high on heavy volumes, with PLI-linked margin support cited. What is your stance?

3. Infosys and Mastercard Announce Global Payments Alliance

DALL-E

Financials: Infosys stock declined −1.93% in today’s risk-off market, with IT sector hits from global tech demand concerns.

Strategy: Announced a major partnership with Mastercard to enhance cross-border payment solutions, aiming to speed transactions and improve security.

Outlook: The move positions Infosys favorably for expansion in global fintech, though sector pressures remain from valuation and growth worries.

Partnership targets faster, safer cross-border payments; stock dipped in risk-off trade. How do you view it?

4. Vardhman Textiles Surges 13% on Cotton Duty Relief

DALL-E

Share gains: Vardhman Textiles jumped 13% to ₹450.20, outperforming the sector after the government extended import duty exemption on cotton until December 31, 2025.

Strategic tailwinds: The exemption is expected to ease cost pressures for mills, spurring production and profitability in the struggling textile sector.

Market impact: The stock reversed a five-day decline and drew heavy trading; positive sentiment may continue if raw material prices stabilize

Import duty exemption extended to Dec 31, 2025. What is your outlook?

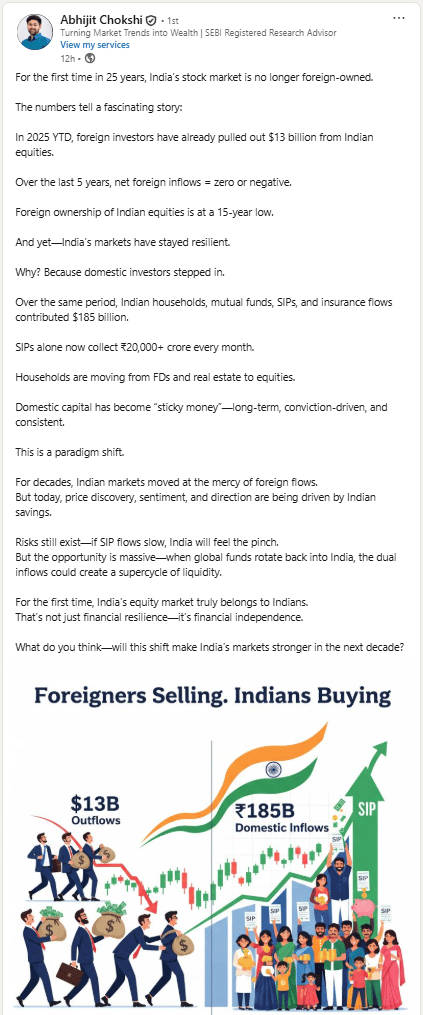

5. Anlon Healthcare IPO Opens

DALL-E

IPO details: Anlon Healthcare’s ₹133 million equity issue opened August 26 and closes August 29, with listing slated for early September.

Company focus: A pharmaceutical API and nutraceutical exporter with ₹120 crore FY25 revenue and ₹20 crore profit, raising capital for working capital and expansion.

Market reaction: Investor appetite remains strong amidst record IPO activity; sector remains optimistic for the remainder of 2025.

₹133 million issue for working capital and expansion; closes Aug 29. Your call?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.