TLDR

📈 Market Recap: July 28, 2025

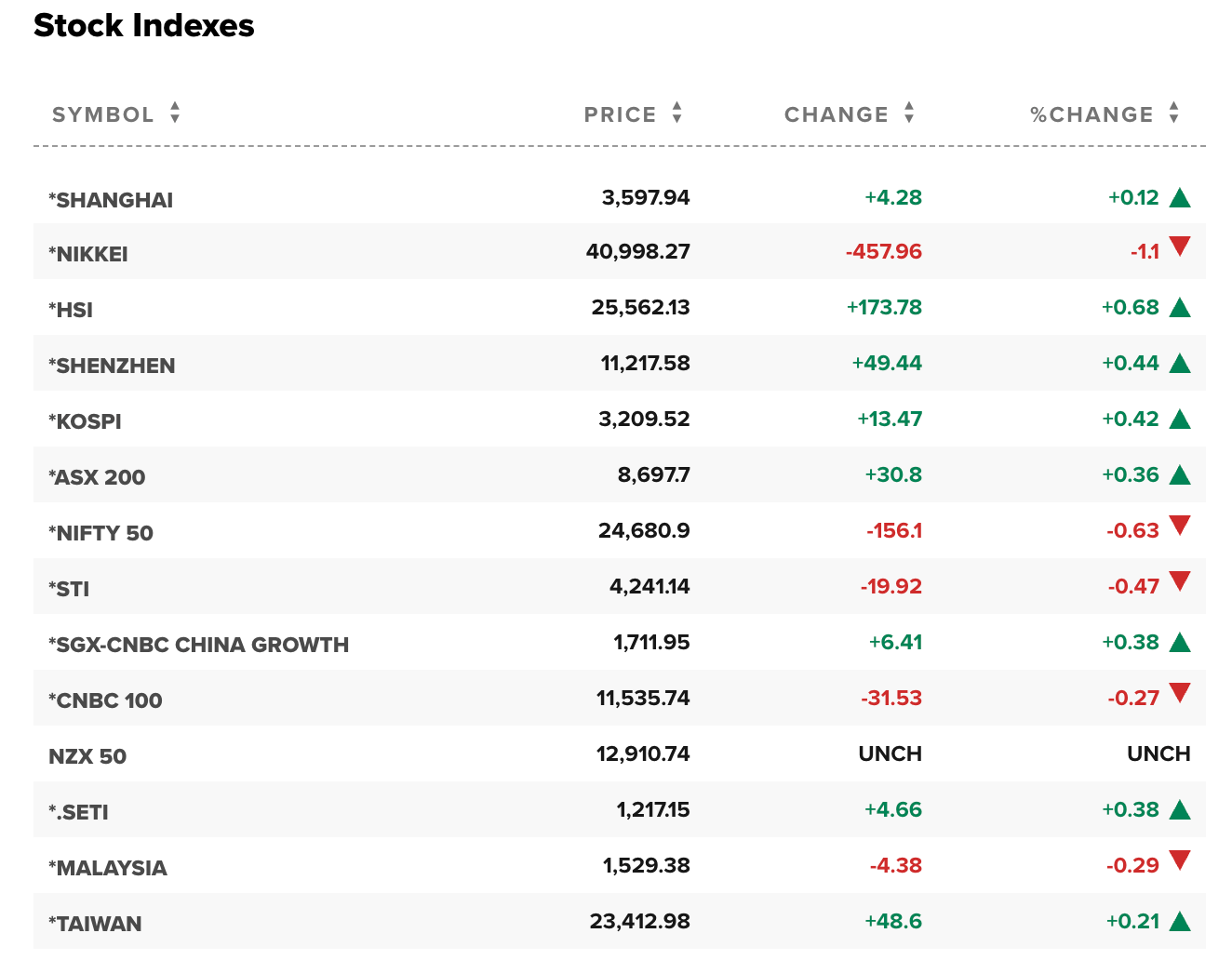

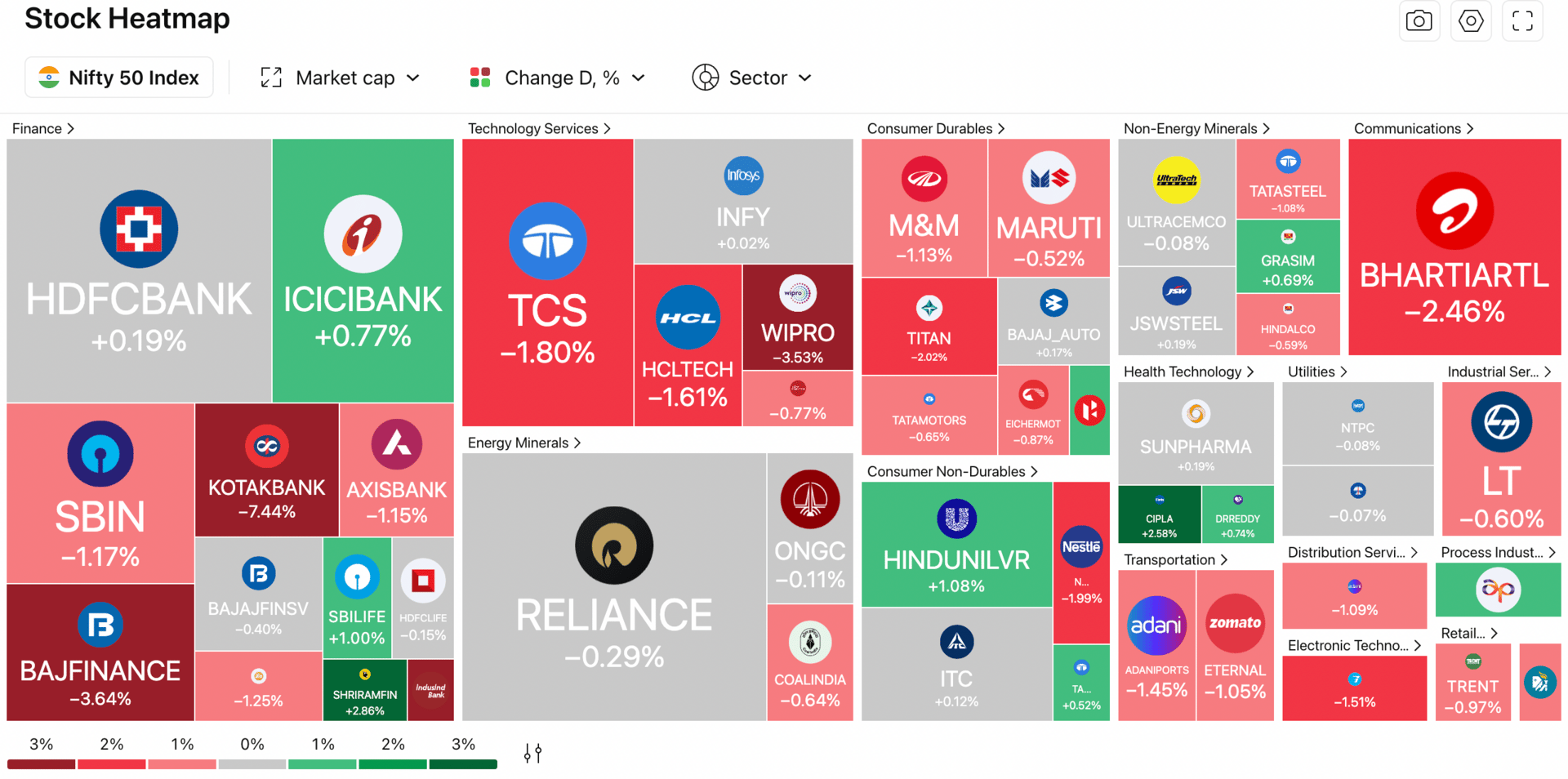

On July 28, 2025, Indian equity markets retreated amid softened corporate earnings and global uncertainty. The BSE Sensex fell 572.07 points (−0.70%) to close at 80,891.02, while the NSE Nifty 50 dropped 156.10 points (−0.63%) to settle at 24,680.90. Broader market indicators underperformed: the Nifty Midcap 100 declined 0.73% and the Nifty Smallcap 100 fell 1.31%. Sectoral losses were led by banking, IT, and realty stocks, while FMCG posted mild gains. Investor sentiment remained subdued as weak results from private banks, global trade deal uncertainty, and continued FII outflows weighed on risk appetite.

Key Drivers:

Banking Drag: Weak Q1 results from Kotak Mahindra Bank and IndusInd Bank weighed heavily on financial indices, with both stocks falling sharply after earnings misses.

FII Outflows: Persistent foreign investor selling continued amid a firm U.S. dollar and rising global bond yields, pressuring broader market sentiment.

IT Weakness: Technology stocks declined as companies like TCS announced headcount cuts and analysts flagged softening global demand across key verticals.

Sectoral Pain Points: Nifty Realty and Media indices dropped 4% and 3% respectively, marking the day’s worst performers, while the India VIX ticked up to 13.2, signaling rising short-term volatility expectations.

Today’s Top Stories:

Kotak Mahindra Bank Slides on Earnings Miss: Kotak Bank shares plunged 7 percent after Q1 net profit declined ~7 percent year-on-year, weighed down by higher provisions and muted credit growth.

RITES Jumps on ₹177 Crore Infra Order: RITES stock surged nearly 6 percent as it secured a key EPC order from Bharat Electronics, expanding its infrastructure footprint and boosting execution visibility.

RailTel Profit Surges 36 Percent in Q1: RailTel reported strong 36 percent YoY profit growth on a 33 percent revenue jump, driven by rising digital infrastructure demand across telecom and rail sectors.

Paras Defence Falls Sharply on Weak Results: Shares of Paras Defence dropped over 10 percent as Q1 PAT declined 25 percent year-on-year, sparking investor concern over cost pressures and margins.

Waaree Energies Profit Soars 89 Percent: Waaree Energies delivered standout Q1 results, with profit nearly doubling on strong solar module demand and operational efficiency, reinforcing leadership in renewables.

TOP STORIES

1. Kotak Mahindra Bank Slides on Earnings Miss

DALL-E

Result snapshot: Q1 FY26 standalone PAT declined ~7 % YoY to ₹3,282 crore; net interest income rose 2.8 %, but credit costs and provisions jumped.

Investor take: Analysts flagged the bank’s conservative loan growth and rising slippages; CLSA and Nomura trimmed estimates amid margin pressure.

Market impact: Shares dropped 7 % to ₹1,667.40, wiping out over ₹21,000 crore in market value and pulling down the Bank Nifty.

Kotak Mahindra Bank slumped 7 percent after Q1 profit fell ~7% and credit provisions rose. What’s your stance after the earnings miss?

2. RITES Jumps on ₹177 Crore Infra Order

DALL-E

Result snapshot: RITES secured a ₹177.22 crore EPC contract from Bharat Electronics for setting up a manufacturing facility in Andhra Pradesh.

Investor take: The deal highlights RITES’ diversification beyond transport consultancy into turnkey infra execution, reinforcing long-term revenue visibility.

Market impact: Shares climbed 6.3% to ₹295.70, leading midcap gainers and hitting their highest level in nearly two months.

RITES shares jumped 6% after bagging a ₹177 crore infra order from BEL. What’s your view on the stock?

3. RailTel Q1 PAT Rises 36% on Digital Infra Momentum

DALL-E

Result snapshot: Q1 FY26 net profit rose 36% YoY to ₹66 crore, while revenue surged 33% to ₹744 crore, led by strong demand in data services and project execution.

Investor take: RailTel’s scalable model in telecom and digital infrastructure continues to benefit from government connectivity projects and railway modernization.

Market impact: Shares gained 4.9% to ₹413.10 on high volume, outperforming broader market declines.

RailTel posted 36% profit growth on digital infrastructure traction. How do you rate the stock’s prospects?

4. Paras Defence Plunges on Q1 Earnings Miss

DALL-E

Result snapshot: Q1 FY26 net profit fell 25% YoY to ₹15 crore, with revenue growth lagging and operating margins under pressure.

Analyst Take: Analysts cited execution delays and higher input costs as key concerns; commentary lacked clarity on near-term margin recovery.

Market impact: Shares sank 10.4% to ₹728.60, extending their two-day loss to over 13% and hitting a six-week low.

Paras Defence tumbled 10% after Q1 profit dropped 25% YoY. What’s your take on the stock post-results?

5. Waaree Energies Soars on 89% Profit Surge in Q1

DALL-E

Result snapshot: Q1 FY26 net profit jumped 89% YoY to ₹745 crore, while revenue rose 30%, driven by robust demand for solar modules and improved cost efficiencies.

Investor take: Analysts praised Waaree’s scale advantage and operational leverage; strong Q1 reinforces its positioning as a renewable energy leader.

Market impact: Shares climbed 5.2% to ₹611.80, extending their year-to-date gain to nearly 28%.

Waaree Energies posted an 89% jump in Q1 profit and 30% revenue growth. How are you positioned?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.