TLDR

Market Recap: February 16, 2026

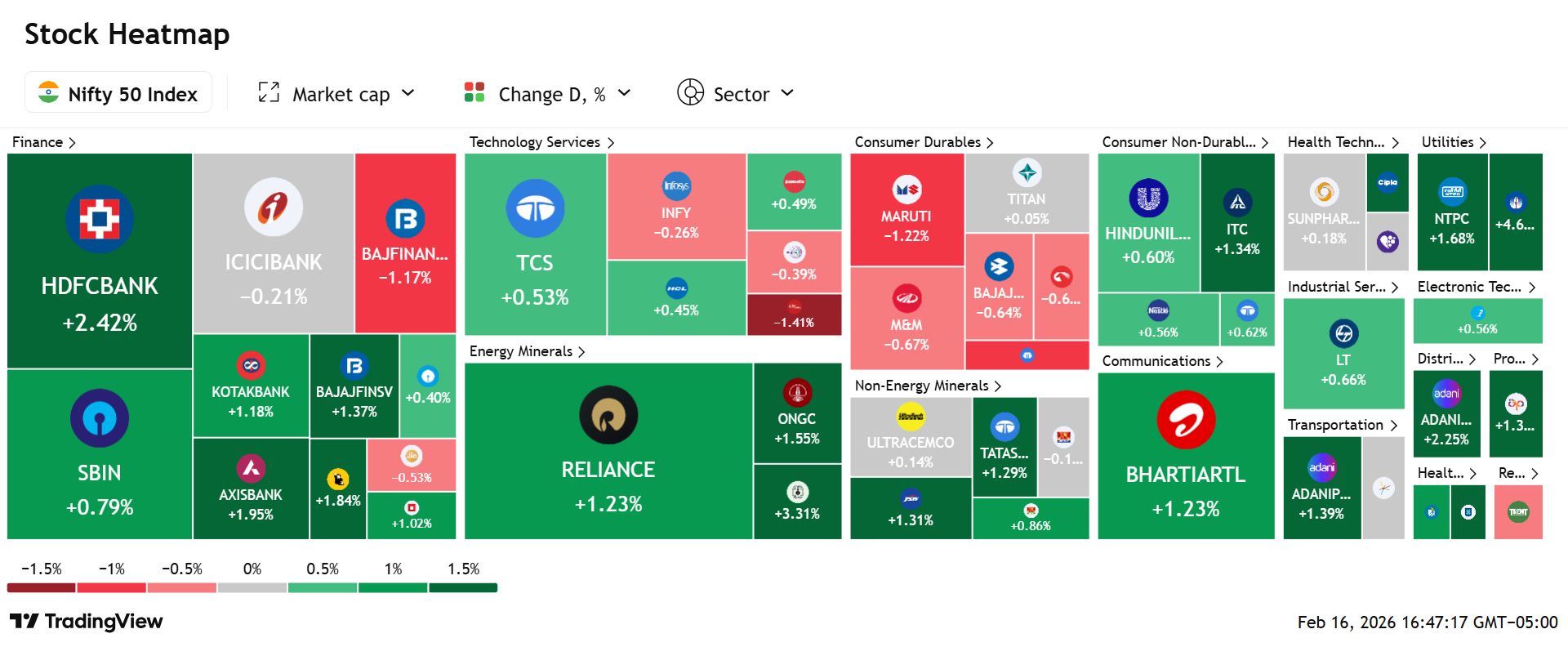

On February 16, Indian equities snapped a two-session slide, led by value buying in heavyweight financials and Reliance, even as volatility stayed elevated and regulatory headlines weighed on capital market intermediaries. The BSE Sensex closed at 83,277.15, up 650.39 points (+0.79%), while the NSE Nifty 50 ended at 25,682.75, up 211.65 points (+0.83%). Broader markets held up with Nifty Midcap 100 up 0.48% and Nifty Smallcap 100 up 0.11%. India VIX inched up to 13.33 (+0.28%), keeping near term risk pricing firm.

Key Drivers :

Value buying in index heavyweights: Banks and Reliance attracted dip buying after last week’s risk-off stretch. This helped stabilise breadth even without a broad risk on chase.

Post IT selloff pause: After the sharp IT drawdown last week, selling pressure cooled, and the sector saw only modest follow-through. That eased index drag into the close.

Volatility stayed bid: India VIX held above 13 despite the rebound, signalling traders are still paying for protection. The tape remains headline sensitive to global macro catalysts.

Today’s Top Stories:

RBI tightens capital market lending: New norms hit BSE and brokerages, forcing a rethink of funding and margin economics.

Fractal debut disappoints: India’s AI listing slipped 5.9%, showing the Street is cautious on AI valuations and near term monetisation.

Natco spikes on Semaglutide nod: Approval triggered a sharp rally as GLP 1 optionality moved from narrative to catalyst.

Torrent Pharma at record high: Strong Q3 momentum and dividends kept buyers active, lifting the stock to fresh highs.

FirstCry tumbles 11.3%: Widened losses and discounting concerns drove a brutal selloff, reviving scrutiny on profitability visibility.

Market Snapshot

CNBC

Nifty 50 Index Heatmap

Trading View

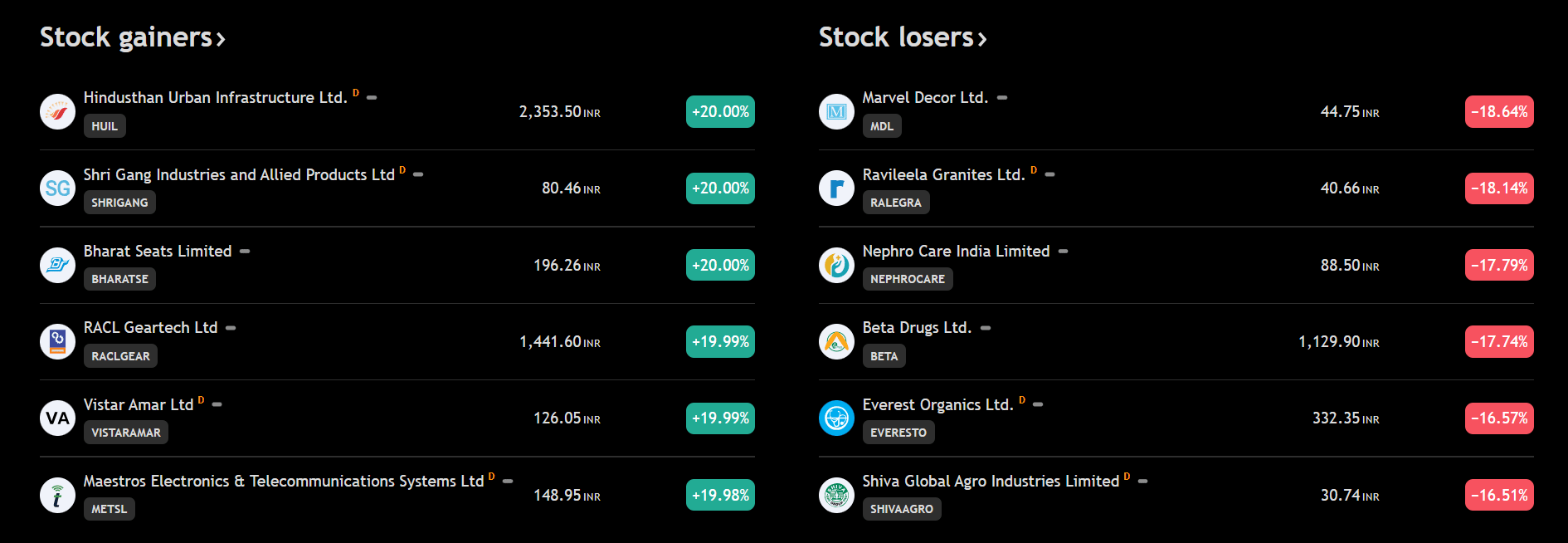

Top Gainers & Losers

Trading View

TOP STORIES

1. RBI Tightens Market Lending, Exchanges Reel

Gemini-2.5

Policy shift: RBI tightened bank funding norms for capital market participants.

Funding squeeze: Stricter guarantees and collateral rules may curb broker leverage.

Immediate impact: Exchange and brokerage stocks fell on regulatory overhang.

RBI tightened funding norms for brokers and exchanges. Market impact?

2. Fractal Debut Falters, Slips 5.9%

Gemini-2.5

Weak listing: AI-focused Fractal fell 5.9% on market debut.

Valuation check: Investors cautious on AI monetization and earnings visibility.

Sentiment signal: Growth narrative alone failed to drive listing pop.

Fractal fell on debut despite AI tag. Your take?

3. Natco Surges on Semaglutide Approval

Gemini-2.5

Regulatory win: Approval to launch Semaglutide in India triggered a sharp rally.

Strategic boost: Strengthens positioning in high-growth GLP 1 opportunity.

Momentum play: Stock outperformed broader pharma peers.

$NATCOPHARM.NSE ( ▲ 0.91% )

Natco rallied on Semaglutide approval. Signal?

4. Torrent Pharma Hits Record High on Q3 Strength

Gemini-2.5

Earnings momentum: Strong Q3 print and dividend kept buyers active.

Defensive bid: Pharma remained preferred amid market volatility.

Fresh highs: Stock scaled record levels despite cautious tape.

Torrent Pharma hit record highs after Q3. View?

5. FirstCry Sinks 11% as Losses Widen

Gemini-2.5

Earnings shock: Widened losses triggered a sharp selloff.

Unit economics watch: Discounting and margin pressure raised concerns.

Sector spillover: Weakness revived scrutiny on new-age listings.

FirstCry plunged after widened losses. Why?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.