TLDR

Market Recap: October 1, 2025

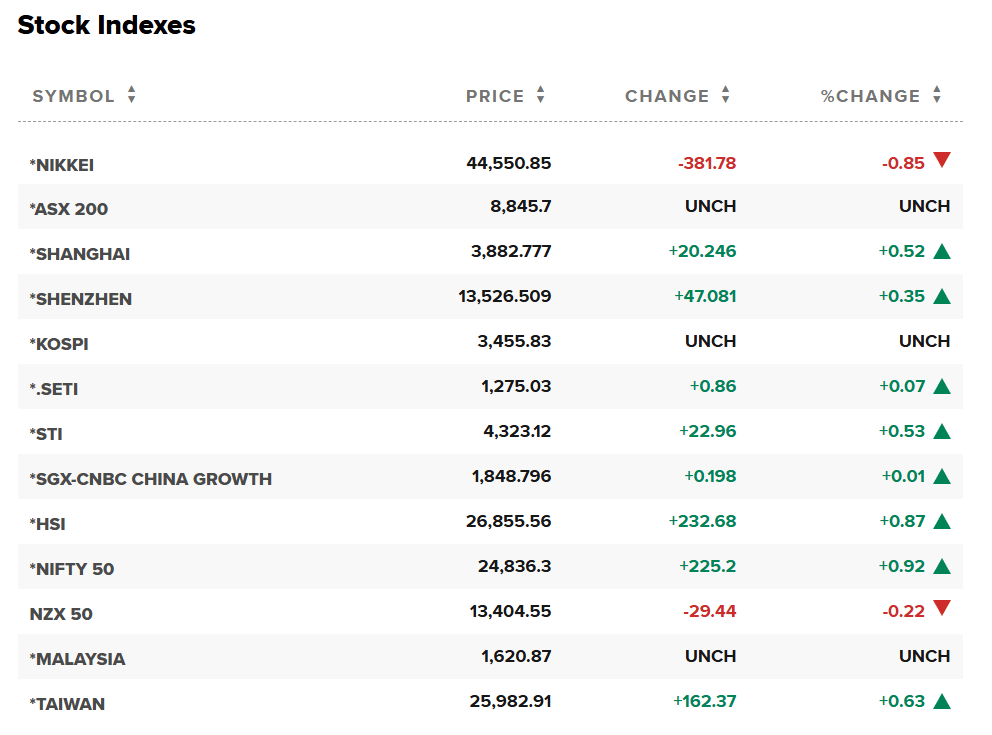

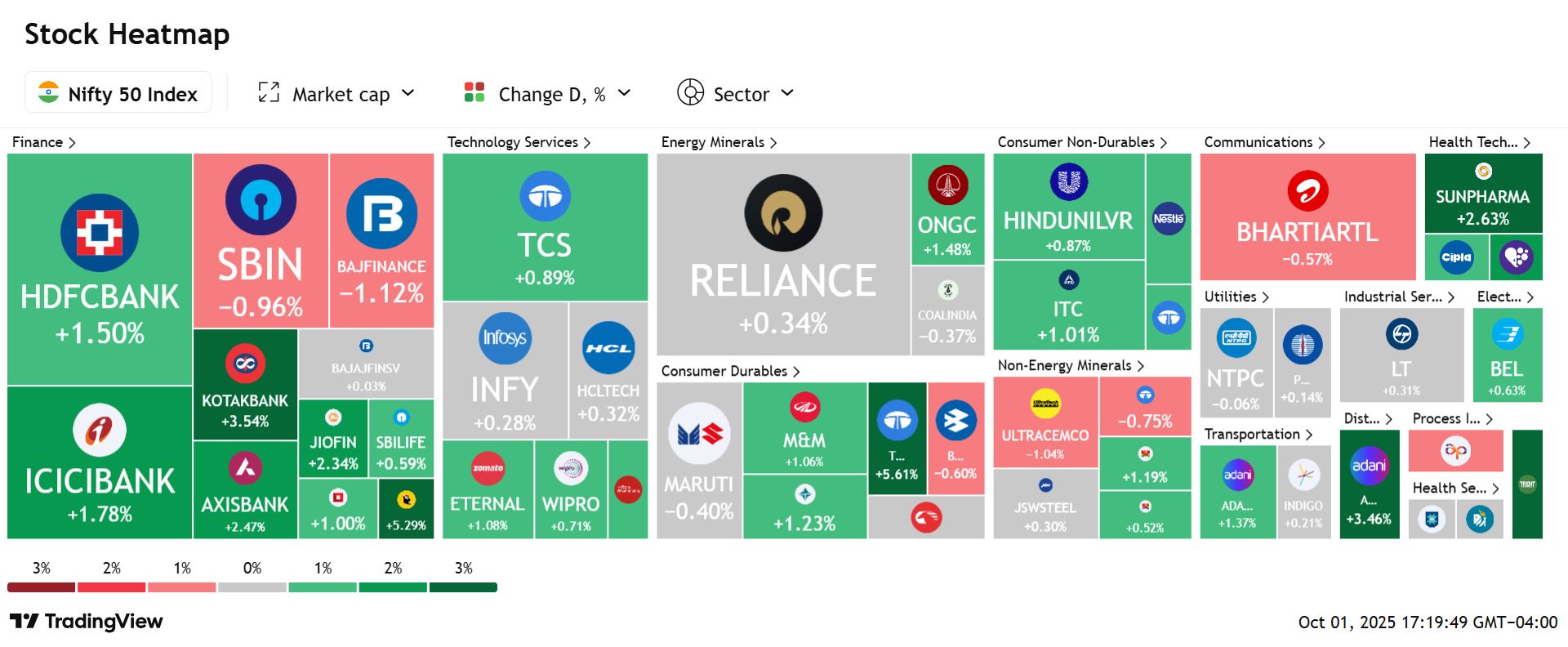

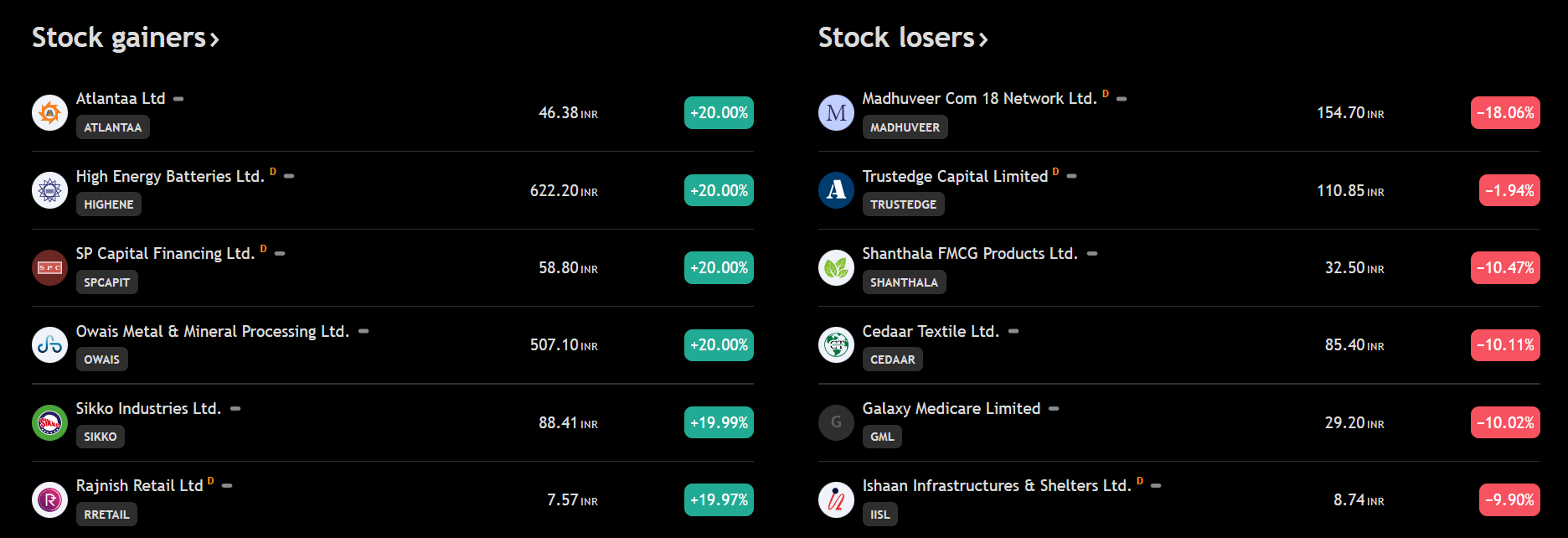

On October 1, 2025, Indian equities rebounded sharply after the RBI held rates and unveiled lending relaxations, snapping an eight-day slide. Sensex 80,983.31 (+715.69, +0.89%) and Nifty 50 24,836.30 (+225.20, +0.92%). Midcaps outperformed (Nifty Midcap 100 57,029.70, +0.89%), while smallcaps gained ~+1.0%. India VIX ~10.2 (≈−7%) signalled cooler risk premia. Provisional flows showed FII −₹1,605 cr and DII +₹2,916 cr. Banks, realty, and IT led; PSU Bank was the lone sector in the red

Key Drivers :

RBI holds, eases credit: Repo unchanged; RBI allowed bank financing of acquisitions, raised caps on IPO financing and loans against shares, and relaxed large-corporate exposure norms, lifting financials.

Flows stabilize at margin: DIIs absorbed supply as FPIs stayed net sellers; month-to-date FPIs pulled $2.7bn through September, per NSDL tallies.

Domestic demand prints: Robust September auto dispatches (Maruti, Hyundai, Mahindra) and festival-season commentary supported cyclicals.

Today’s Top Stories:

RBI lending reset: Banks can fund acquisitions; higher IPO/LAS caps private banks led’ gains.

Tata Motors demerger: PV-CV split effective; record date set; stock jumps ~5%.

Maruti exports record: Sep sales 1.90 lakh; exports at an all-time high of 42,204 units.

Coal India slip: Sep output −3.9% YoY to 48.97 MT; offtake −1.1%.

Tata Capital IPO: ₹310 - ₹326 band; Oct 6 - 8 bookbuild amid busy Q4 pipeline.

TOP STORIES

1. RBI’s lending revamp lifts private banks; Nifty Private Bank +2%

DALL-E

Policy changes: RBI will allow banks to fund acquisitions, raise the IPO financing cap to ₹2.5 lakh (from ₹1 lakh) and LAS cap to ₹20 lakh (from ₹2 lakh), and relax large-corporate lending limits, part of 22 measures to spur credit.

Strategic read-through: Broader bank participation in M&A and primary markets can deepen fee pools and working-capital lines; phased capital-rule timelines ease near-term CET1 pressure.

Market reaction: Financials led the rally; Nifty Private Bank ~+1.97%, banks and diversified financials +1.3-1.4%

RBI eases capital-market and M&A lending norms. Your take on the impact for banks and credit growth?

2. Tata Motors demerger goes live; record date announced

DALL-E

Corporate action: The PV - CV demerger became effective today (Oct 1); the company outlined record-date logistics for share entitlements in October - November.

Operational angle: Separation is aimed at sharper capital allocation and unlocking multiples across distinct PV, EV, and CV cycles; governance clarity may reduce conglomerate discount.

Market reaction: Tata Motors rallied ~5% intraday on the announcement; cash close printed higher week-on-week.

PV-CV split is effective. What’s your view on value unlock from the demerger?

3. Maruti Suzuki hits all-time monthly export high in September

DALL-E

Sales print: Total 189,665 units for Sep-25; exports 42,204, an all-time monthly high; domestic mix softened in select entry segments.

Strategic/ops: Strong exports help utilization and FX mix as domestic small-car demand normalizes; festival deliveries flagged as robust in early Navratri days.

Market reaction: MARUTI closed marginally lower (- 0.3%), trailing the index despite healthy exports.

Record monthly exports support utilization and mix. How do you position on Maruti now?

4. Coal India’s September output slips 3.9% YoY to 48.97 MT

DALL-E

Operational update: Provisional production 48.97 MT vs 50.94 MT YoY; offtake 53.56 MT (-1.1% YoY). Monsoon-related disruptions cited.

Implication: A softer September could tighten near-term supply for power utilities if pickup lags; FY26 target trajectory bears watching into post-monsoon ramp-up.

Market reaction: Stock sentiment tracked broader rally; investors will watch October run-rate and e-auction realizations.

Production slipped in September amid weather headwinds. Your stance on Coal India near term?

5. Tata Capital IPO set for Oct 6-8; price band ₹310-₹326

DALL-E

Deal terms: India’s largest 2025 float targets ~₹15,500 cr via fresh + OFS; anchors on Oct 3; books Oct 6-8. Proceeds to bolster Tier-1 and growth.

Strategic/ops: Listing of a systemically important NBFC adds depth to financials; comes amid a broader $8bn Q4 IPO pipeline.

Market reaction: Financials bid on primary-market momentum; pricing vs listed NBFC comps (P/B & ROE) will drive allocation

Large NBFC IPO is coming to market. What’s your plan?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.