TLDR

Market Recap: August 6, 2025

On Wednesday, August 6, 2025, Indian equity markets ended in the red as the Reserve Bank of India kept the benchmark repo rate unchanged at 5.5% and maintained a neutral policy stance, offering no signals of an upcoming rate cut. The RBI’s cautious tone on inflation and liquidity dampened investor sentiment, leading to broad-based profit booking across rate-sensitive sectors. Global weakness and fresh concerns over potential U.S. tariffs on key Indian exports such as pharmaceuticals and engineering goods added to the risk-off mood.

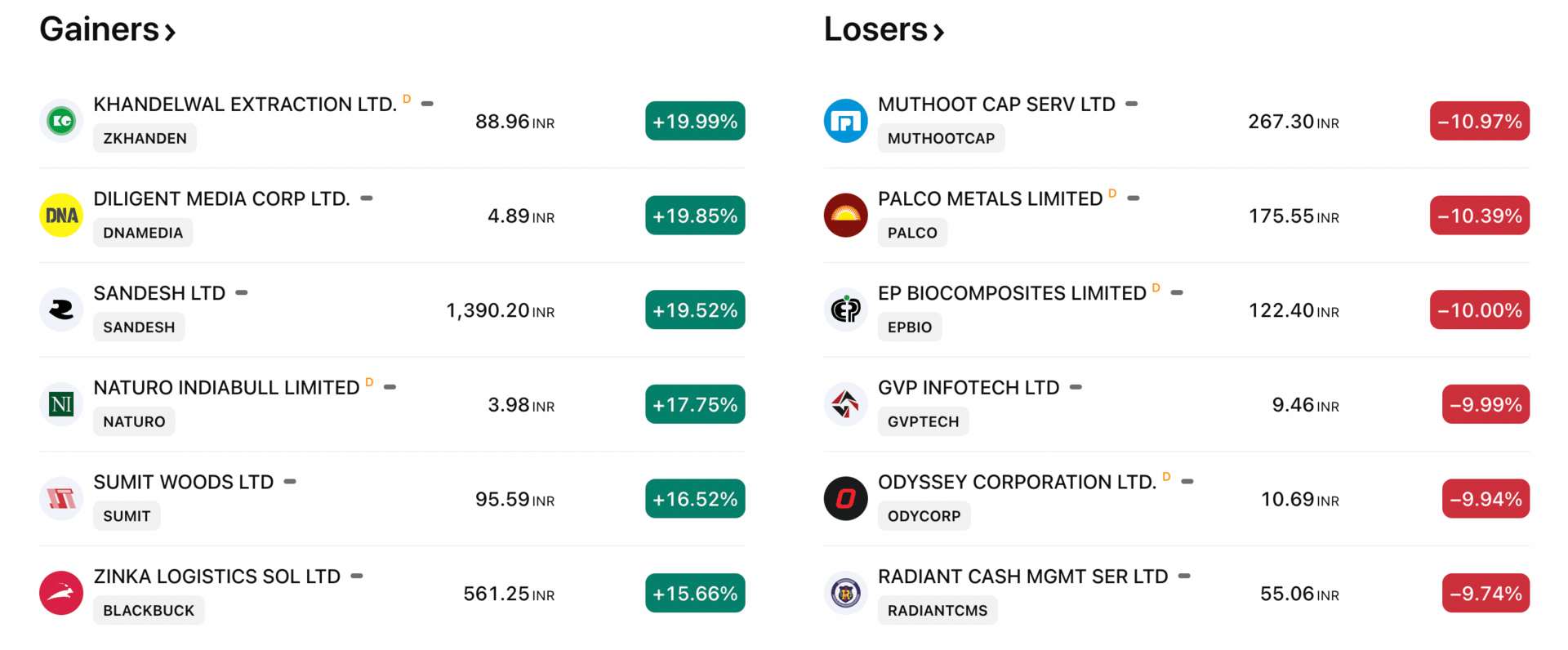

The Sensex slipped 166 points to close at 80,543.99, while the Nifty 50 fell 75 points to 24,574.20. Mid- and small-cap indices declined around 1% each, and the India VIX spiked over 3%, reflecting heightened volatility. IT, realty, auto, and FMCG stocks dragged, while PSU banks outperformed modestly on continued credit growth. Market breadth was broadly negative, with more than 70% of NSE stocks closing lower.

Key Drivers:

RBI status quo with neutral tone: The Reserve Bank of India held the repo rate steady at 5.5% and retained a neutral policy stance, offering no cues on rate cuts, which disappointed markets expecting dovish forward guidance.

Inflation and growth balancing act: While inflation projections were slightly revised downward, the RBI flagged upside risks from food prices and global supply chains, signaling caution in its policy path.

Weak global cues and U.S. tariff threats: Renewed U.S. trade rhetoric, including tariff threats on Indian pharmaceutical and engineering exports, raised geopolitical concerns and added external pressure on equities.

Selling in rate-sensitive sectors: Realty, auto, and financial stocks saw broad-based selling amid uncertainty around borrowing costs and muted commentary from the central bank.

Volatility spike amid broad market weakness: India VIX rose over 3%, and over 70% of NSE stocks declined, highlighting widespread nervousness among traders ahead of global and domestic macro headwinds

Today’s Top Stories:

Power Finance Q1 PAT +25% and dividend declared

Profit surged to ₹8,981 cr; revenue rose 15.5%; dividends signal confidence.Bajaj Auto Q1 profit climbs 14% on higher volumes

PAT ₹2,210 cr, revenue ₹13,133 cr; strong domestic and export mix.PVR Inox loss narrows sharply as revenue up 23%

Box office, advertising, and F&B recovery drive recovery.NSDL IPO lists ~10% above issue price

Strong debut at ₹880 reflects high investor interestAsian Paints stock rallies 2.2% on a weak trading day

Outperforms peers leveraging brand resilience amid market-wide losses.

TOP STORIES

1. Power Finance Corporation Q1 Profit Up 25%

DALL-E

Financials: PFC reported consolidated net profit of ₹8,981 crore in Q1 FY26, a 25% YoY increase from ₹7,182 crore, backed by 15.5% YoY growth in total revenue to ₹28,539 crore.

Operational metrics: Net interest income grew 26% to ₹5,469 crore; loan asset book expanded ~13% YoY to ₹11.34 lakh crore; quarterly disbursements surged 1.5x to ₹95,660 crore; gross NPA declined to 1.47% and net NPA to ~0.31%, reflecting strong asset quality .

Strategic outlook: The company declared an interim dividend of ₹3.70 per share; asset growth, improving asset quality and peak disbursements underscore management confidence in sustaining momentum through FY26.

What’s your view on PFC’s strong Q1 earnings and dividend announcement?

2. Bajaj Auto Q1 PAT Rises 14%

DALL-E

Financials: Bajaj Auto reported a consolidated net profit of ₹2,210 crore in Q1 FY26, up 14% YoY from ₹1,942 crore, while revenue from operations grew 10% to ₹13,133 crore.

Operational metrics: Export volumes rose 16%, driven by strong sales across Africa, Latin America, and Asia; electric Chetak scooter volumes more than doubled YoY (now contributing over 20% of domestic revenue); premium motorcycles (KTM, Triumph) and commercial vehicles also posted solid growth .

Strategic outlook: Bajaj continues to focus on its premiumisation and EV strategy, with expanding global reach and doubling EV penetration in domestic mix; it is also advancing its proposed controlling stake acquisition in KTM by mid‑2026 to bolster premium segment leadership.

How do you see Bajaj Auto’s Q1 performance and outlook?

3. PVR Inox Q1 Loss Narrows Sharply

DALL-E

Financials: The company reported a Q1 FY26 loss of ₹54 crore, down from ₹178.70 crore YoY, as revenue surged 23% to ₹1,469.1 crore. The improvement was driven by a strong film slate and operational recovery across formats.

Operational metrics: Ticket sales rose ~12% and average ticket price increased 8%, while food & beverage and ad revenue also posted healthy growth. These indicators suggest a return of consumer confidence in theatrical experiences.

Strategic outlook: PVR Inox plans to add 90–100 new screens in FY26, supported by reduced net debt and post-merger synergies. This expansion signals management's confidence in long-term demand growth

What’s your take on PVR Inox’s narrowing loss and revenue growth?

4. NSDL IPO Lists ~10% Above Issue Price

DALL-E

Listing performance: NSDL shares debuted around ₹880, about 10% above the issue price of ₹800, reflecting strong investor demand. The listing premium was in line with expectations for a first-mover in India’s depository space.

Valuation appeal: Investors found NSDL's pricing attractive compared to peer CDSL, especially considering its market share and stability. Demand was also supported by anchor backing and institutional interest.

Outlook: Analysts recommend holding the stock post-listing, citing its strategic position in India’s growing capital markets ecosystem. Further re-rating is expected as demat account penetration rises.

How are you approaching NSDL post its 10% premium listing?

5. Asian Paints Outperforms on Weak Market Day

DALL-E

Stock performance: Asian Paints gained 2.2% to ₹2,491.30, sharply outperforming the Nifty which fell 0.3% on the day. This strength came as most FMCG peers struggled amid profit-taking.

Relative strength: It beat sector rivals like Shalimar Paints (–2%) and Jenson & Nicholson (–4.8%), showing resilience in a falling market. The outperformance highlighted investor preference for high-quality defensives.

Demand drivers: Strong brand equity, diversified product mix, and steady demand across urban and rural areas helped the company attract flows. Analysts continue to view it as a stable compounder during volatile phases.

Asian Paints Outperforms on Weak Market Day

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.