TLDR

Market Recap: September 25, 2025

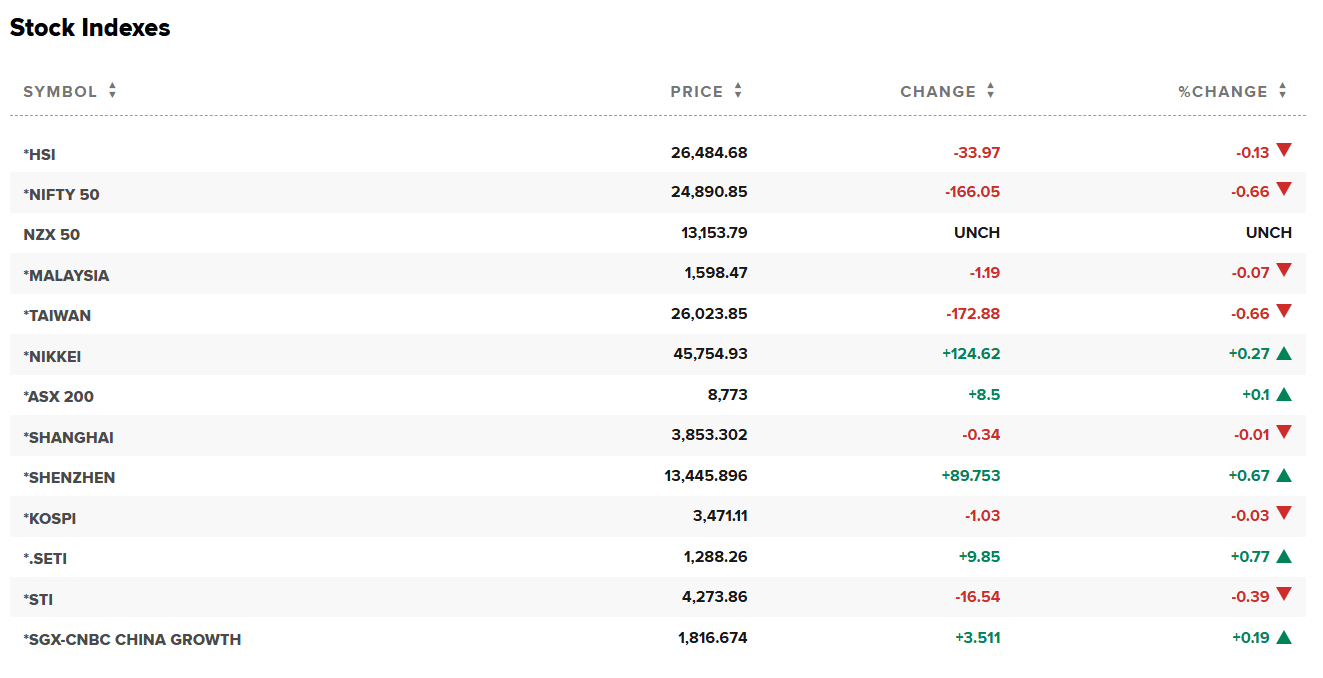

On September 25, 2025, Indian equities extended losses for a fifth straight session amid persistent FPI outflows and global policy jitters. Sensex closed at 81,160 (-556 pts, -0.68%) and Nifty 50 at 24,890.9 (-166 pts, -0.66%). Midcap and Smallcap gauges lagged, with Nifty Midcap 100 -0.64% and Nifty Smallcap 100 -0.57%. India VIX inched up to ~10.8 as risk appetite cooled. Sectorally, autos underperformed while energy and staples showed resilience; FPI selling stayed elevated this week.

Key Drivers :

FPI outflows, visa overhang: Foreign investors net sold equities mid-week; chatter about U.S. H-1B fees kept IT sentiment cautious.

Defensive stocks rotate: Energy and consumer names eked out gains as crude oil prices stayed firm, and select staples saw upgrades.

Vol edges up: India VIX rose to ~10.8 as indices slipped below key supports, flagging near-term caution.

Today’s Top Stories:

HAL gets ₹62,370 cr Tejas order: Big backlog boost; stock up on execution visibility.

StanChart USD clearing at GIFT from Oct 7: Adds heft to India’s offshore finance hub.

FDI tweak for e-com exports under review: Possible tailwind for Amazon/Flipkart-led export flows.

LG Electronics India to float ₹11,500 cr IPO in early Oct: Potential benchmark for consumer-electronics listings; peer read-through modest today.

Tata Motors hit by JLR outage: Systems partially restored, but production remains halted; stock slides.

TOP STORIES

1. HAL inks ₹62,370 crore Tejas Mk-1A order with MoD

DALL-E

Financial development: The MoD placed a ₹62,370 crore (~$7.0 bn) order with Hindustan Aeronautics (HAL) for additional Tejas Mk-1A fighters, expanding the IAF fleet.

Strategic implications: Order visibility strengthens HAL’s backlog and cash flows, reinforcing India’s defense indigenization roadmap and production scale-up.

Market impact: HAL shares finished ~+1.1%; intraday gains topped 2% as investors priced in multi-year execution.

After the MoD placed a ₹62,370 crore Tejas Mk-1A order with HAL, backlog and visibility improve. Your view on HAL’s risk-reward?

2. Standard Chartered to start USD clearing from GIFT City on Oct 7

DALL-E

Financial development: StanChart India will launch U.S. dollar clearing operations from GIFT City, enhancing the IFSC’s settlement stack.

Strategic implications: Adds depth to India’s offshore financial center, potentially aiding treasury, trade finance, and capital-market flows.

Market impact: No listed India unit; read-through positive for GIFT-linked ecosystem and India’s cross-border banking capabilities.

Standard Chartered will start U.S. dollar clearing from GIFT City in early October. How consequential is this for India’s IFSC?

3. Govt mulls FDI rule tweak to boost e-commerce exports

DALL-E

Financial development: India is considering changes to foreign investment rules for export-led e-commerce, a potential win for platforms like Amazon/Flipkart.

Strategic implications: Could unlock vendor onboarding and logistics efficiencies for cross-border sales, nudging more MSMEs to export digitally.

Market impact: Limited direct equity read-through today; watch logistics, warehousing, and payment facilitators for sentiment spillover.

Government is considering changes to FDI rules to boost export-led e-commerce. What’s your policy take?

4. LG Electronics India plans ₹11,500 crore IPO in early October

DALL-E

Financial development: LG Electronics’ India unit is preparing an IPO of roughly ₹11,500 crore ($1.3 bn), targeted for the week of Oct 6; implied valuation about $9 bn, per Bloomberg.

Strategic implications: A marquee consumer-electronics listing could set pricing reference points for India’s EMS and appliances ecosystem while broadening large-cap non-tech consumer options for domestic funds.

Market impact: Read-through to contract manufacturers and appliance peers; Dixon traded marginally higher today, and Amber was near flat intraday

LG’s India unit is lining up a large IPO in early October. What’s your stance?

5. Tata Motors under pressure as JLR cyber incident drags on

DALL-E

Financial development: JLR said some systems are back online, but UK production remains disrupted after the early-September cyberattack.

Strategic implications: Extended shutdown raises near-term revenue and working-capital risks; UK government monitoring supplier stress.

Market impact: Tata Motors closed -2.7% today; down 5% over two sessions on mounting cost concerns

JLR’s cyber incident keeps UK production disrupted despite partial system restores. What’s the stock setup near term?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.