TLDR

Market Recap: December 18, 2025

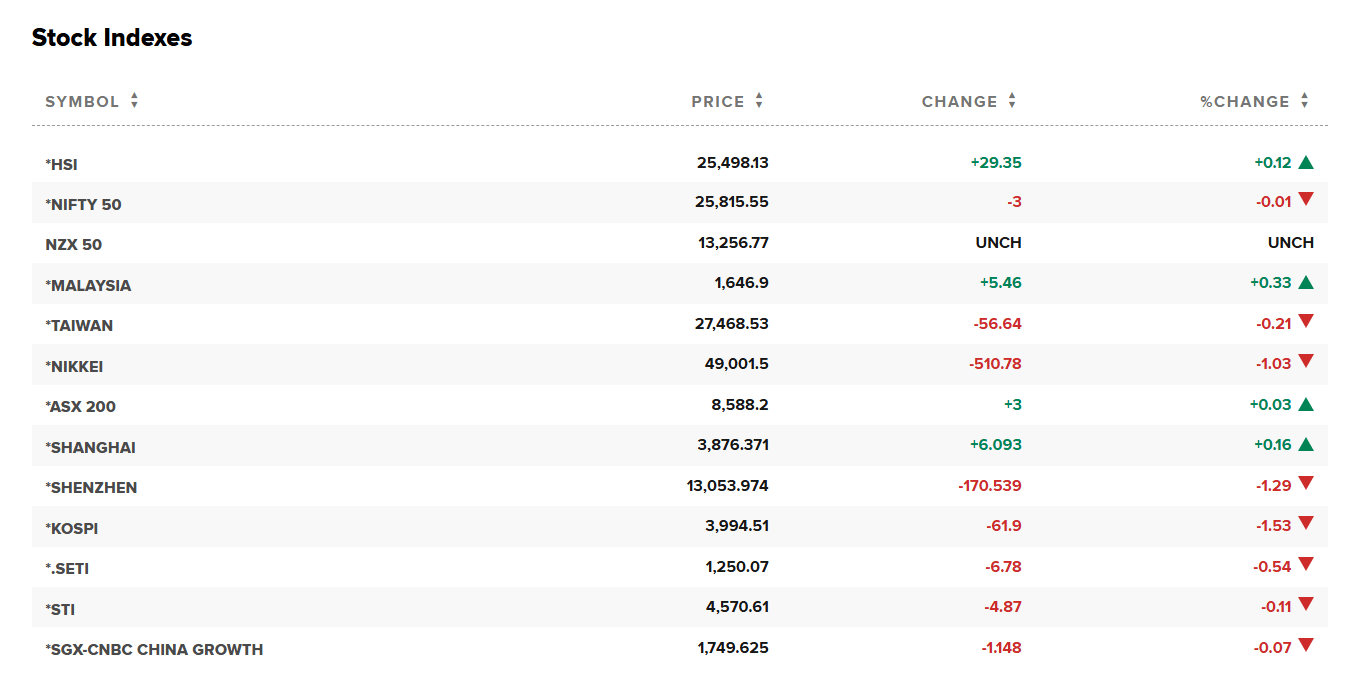

On December 18, Indian equities ended almost flat in a choppy, expiry-day session, extending the recent drift lower: Sensex closed at 84,481.81 (down 77.84, -0.09%) and Nifty 50 at 25,815.55 (down 3.00, -0.01%). Broader markets held up with Nifty Midcap 100 up ~0.3% and Nifty Smallcap 100 up ~0.1%, while India VIX eased to 9.70 (down 0.14, -1.42%), signaling very low implied volatility despite late-session profit-taking. Sectorally, IT strength capped losses as investors tracked global data risk and near-term positioning; the latest reported institutional flow print still showed net buying into the dip.

Key Drivers :

Expiry-day chop, no fresh triggers: Benchmarks swung intraday but faded into the close as traders stayed cautious ahead of key US inflation data and near-term event risk.

IT pocket of strength: Nifty IT-led sectoral gainers, helping limit headline damage even as most sectors finished in the red.

Flows supportive, but timing lag: Latest exchange-reported data (through Dec 17) shows FPIs and DIIs net buyers, offering a floor even as the index extends a multi-session pullback.

Today’s Top Stories:

SEBI MF brokerage cap 6 bps: Fee shock eases; capital market stocks breathe.

TML02: Bullish initiations spark pop; focus moves to CV cycle data.

Ola Electric: Founder selling pressure stock; supply optics dominate.

IndiGo: Ops-stability message lifts shares; execution proof still needed.

Sun Pharma: USFDA OAI raises delay risk; stock reacts lower.

TOP STORIES

1. SEBI sets MF brokerage cap at 6 bps

Gemini-2.5

Financial: SEBI caps equity cash brokerage at 6 bps. Earlier 2 bps worry cools.

Strategic: Distributor economics get relief. Implementation details are now key.

Market impact: Capital market names saw a relief bid. Fee shock narrative fades.

SEBI capped MF brokerage at 6 bps. Your read?

2. Tata Motors CV (TML02) jumps on JPMorgan and BofA initiations

Gemini-2.5

Financial: JPMorgan and BofA initiate bullish. Both cite the ₹475 target.

Strategic: Street leans into CV upcycle. Focus shifts to volumes and margins.

Market impact: The stock surged by nearly 5% intraday. Momentum turns coverage-led.

Tata Motors jumped on fresh bullish coverage. What next?

3. Ola Electric hits fresh lows after founder share sale

Gemini-2.5

Financial: Founder sold more shares (4.2 crore, ₹142 cr). Linked to loan repayment (₹260 cr).

Strategic: Optics around supply and governance rise. “Zero-pledge” messaging gets tested.

Market impact: The Stock fell 5% to new lows. Sentiment stays fragile.

Founder selling hit Ola Electric. Your stance?

4. IndiGo rebounds on “worst is behind us” message

Gemini-2.5

Financial: CEO says ops stabilized. Network back near 2,200 flights.

Strategic: Execution and reliability are the core watch. External review adds credibility.

Market impact: The stock rose by up to 2.6%. Market wants proof, not quotes.

IndiGo says “worst is behind.” Do you buy it?

5. Sun Pharma slips after USFDA OAI on Baska facility

Gemini-2.5

Financial: USFDA classifies the site as OAI. Approval timelines may extend.

Strategic: Remediation pace becomes the main driver. Launch cadence risk gets repriced.

Market impact: Stock underperformed on regulatory overhang. Updates will move the tape.

Sun Pharma gets USFDA OAI tag at Baska. Market impact?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.