TLDR

Market Recap: October 13, 2025

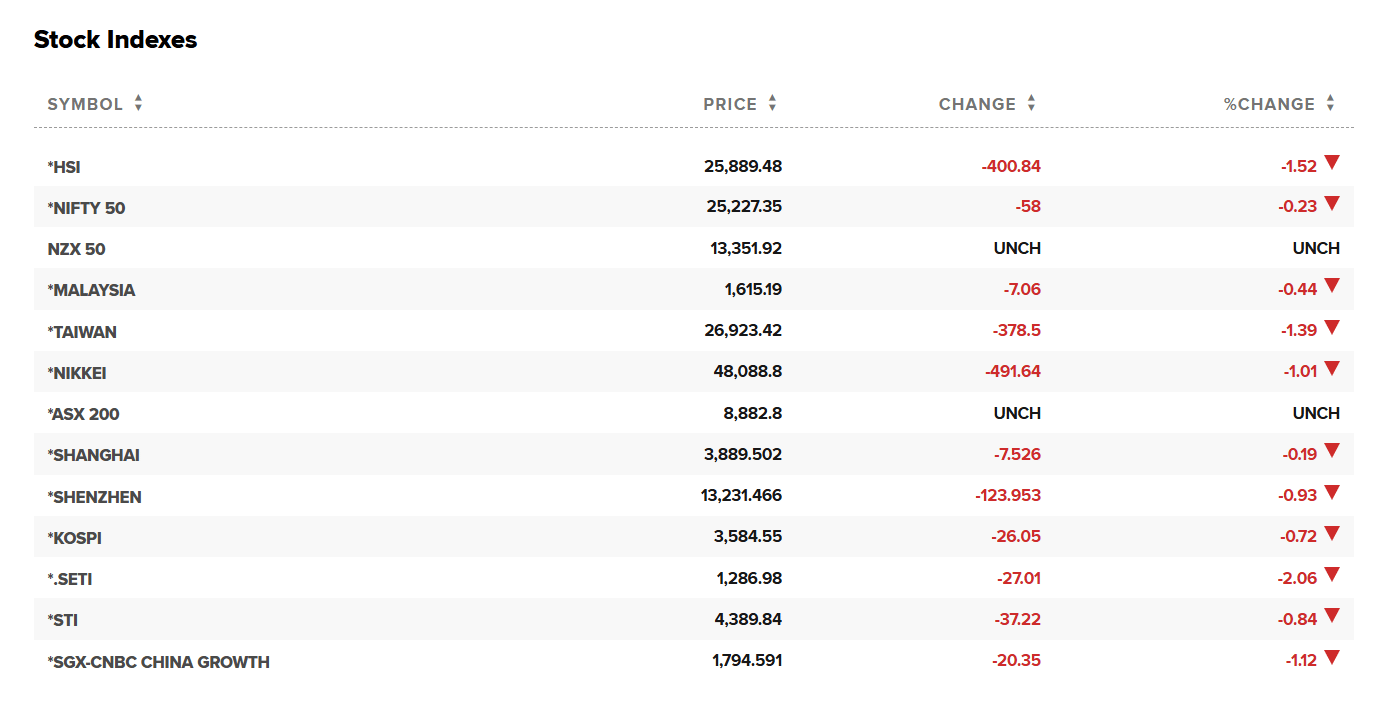

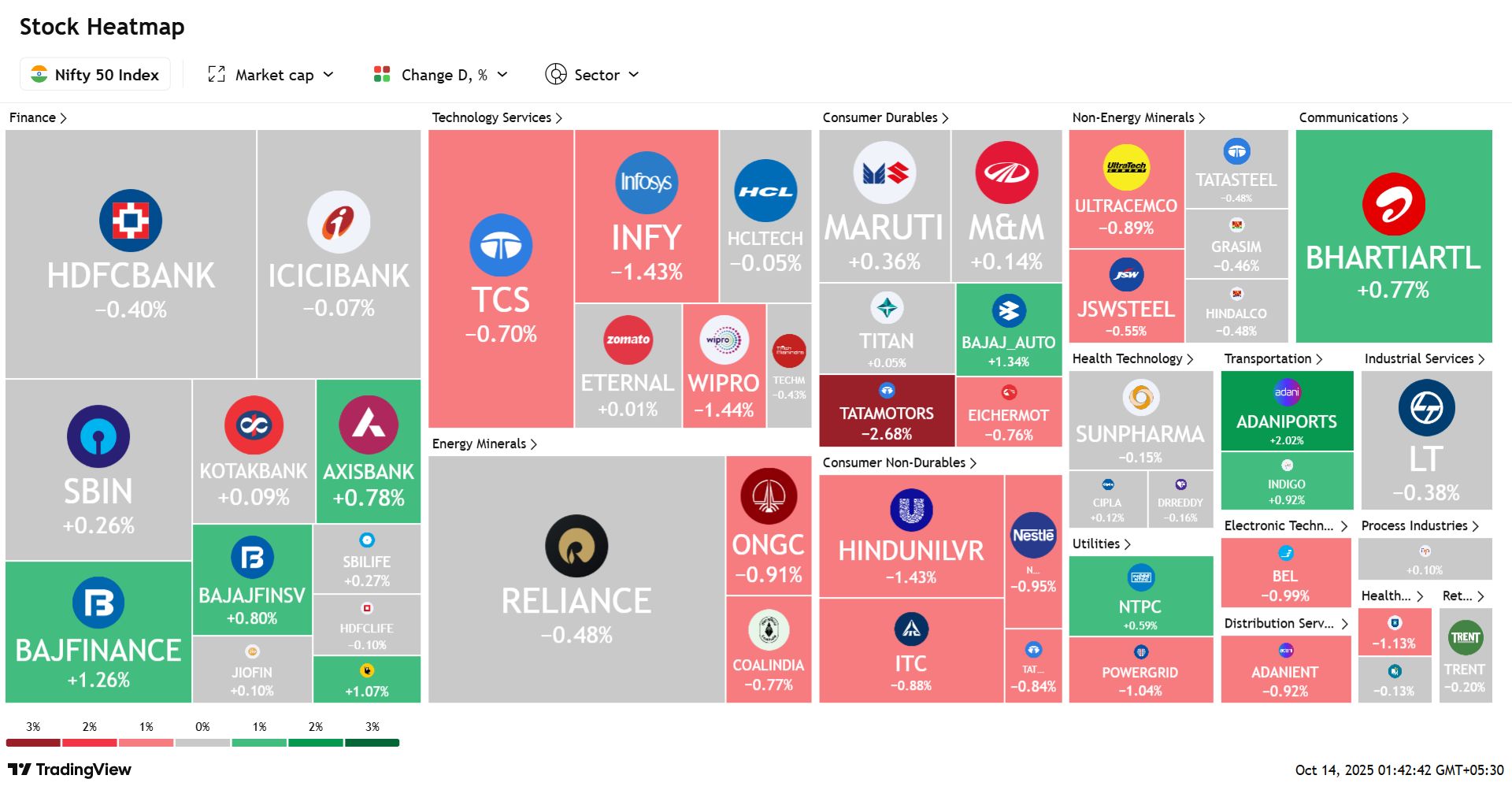

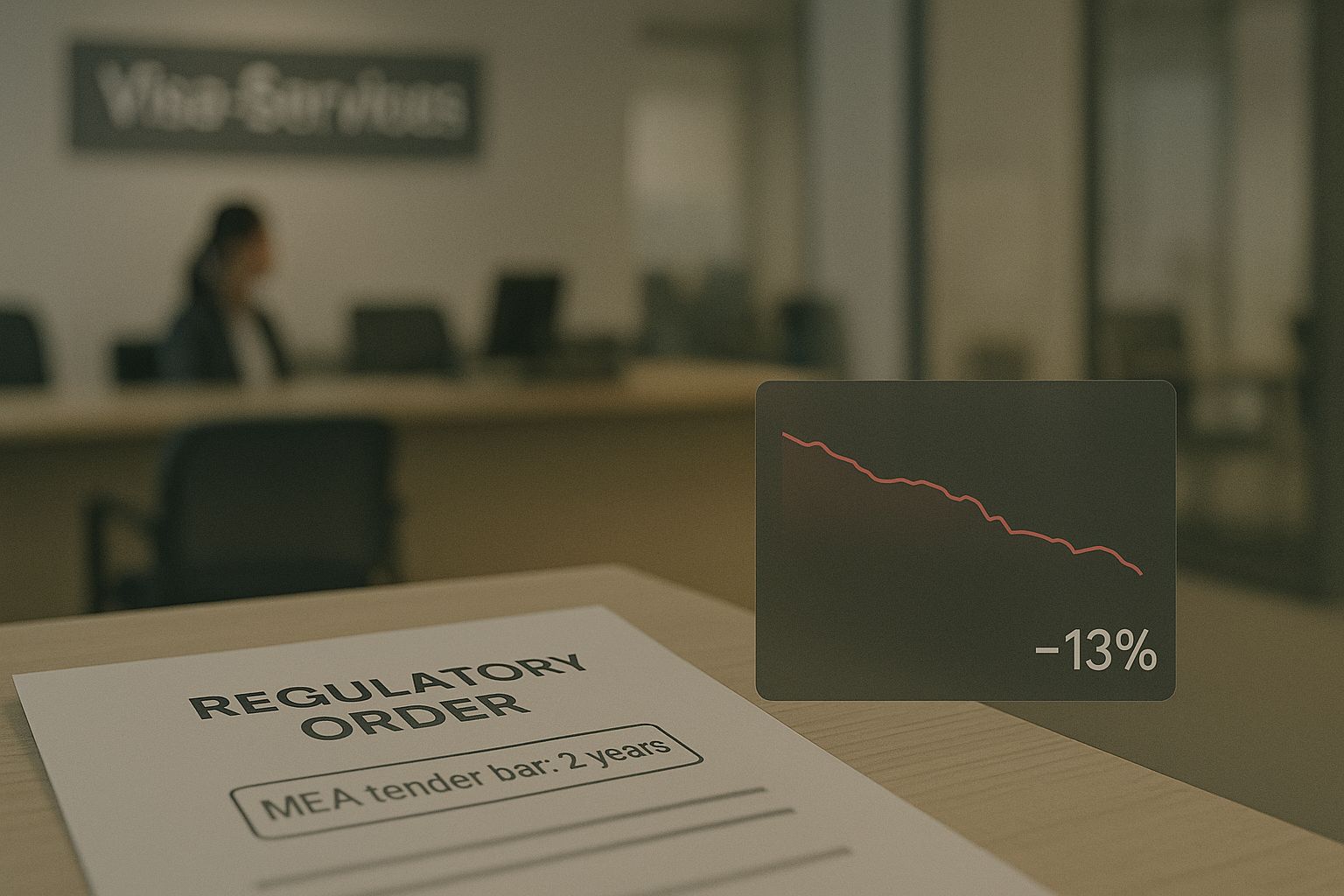

On October 13, 2025, Indian equities slipped as tariff jitters kept risk appetite in check: Sensex 82,327.05 (−174 pts, −0.21%), Nifty 50 25,227.35 (−58 pts, −0.23%); Nifty Midcap 100 +0.11%, Nifty Smallcap 100 −0.17%. India VIX 10.99 (+9%), reflecting a mild volatility uptick. Selling in IT/FMCG offsets resilience in banks/realty. The rupee hovered near its record low around ₹88.74/$ amid RBI-watchful trade. FII/DII: today’s provisional prints were not released at copy time; Oct 10 showed FII +₹459 cr, DII +₹1,708 cr (provisional).

Key Drivers :

Tariff shock keeps a lid on risk: Fresh US-China tariff headlines weighed on Asia and India; sentiment improved late as lows were bought.

Flows and FX under watch: With FIIs choppy and the rupee near 88.8/$, traders eyed RBI steadiness and domestic DII support.

Earnings and primary market lens: HCLTech Q2, Tata Capital listing, and stock-specific movers (BLS, Waaree, DMart) drove dispersion.

Today’s Top Stories:

Tata Capital’s cool debut: Lists 1% above issue; valuation hefty, premium restrained.

HCLTech steady Q2: Revenue beats, profit flat; ₹12 dividend; guidance intact.

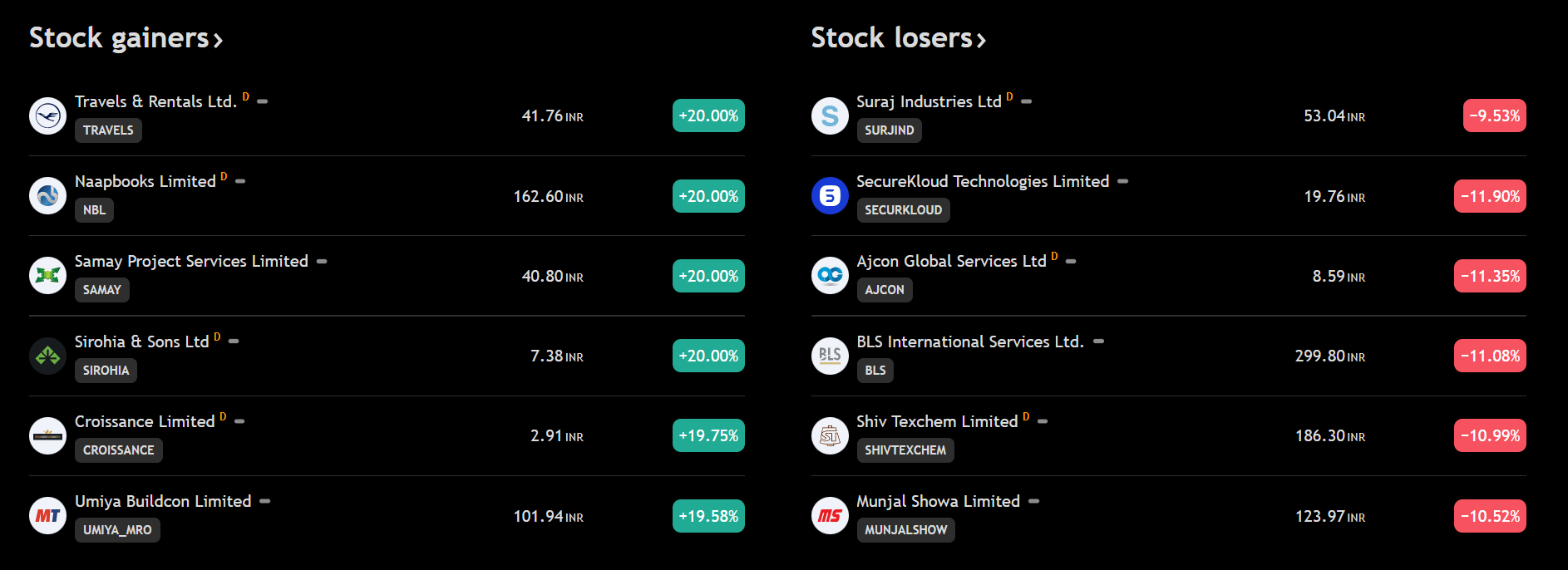

BLS hit by tender bar: 2-year MEA restriction sparks double-digit fall.

Waaree Renewable pops: Record Q2 lifts stock toward highs on strong execution.

DMart mixed: Solid sales, lean margins; stock eases.

TOP STORIES

1. Tata Capital lists flat-to-soft vs hype

DALL-E

Listing math: India’s largest 2025 IPO debuted 1.2% above ₹326 at ₹329.8, valuing the NBFC at ~₹1.4 trillion.

Strategy signal: Proceeds shore up capital ratios to fund retail and SME growth; peers’ rich valuations capped day-one pop.

Market reaction: Muted premium and weak tape kept gains in check; NBFC pack was mixed.

Tata Capital listing came in muted. What’s your stance now?

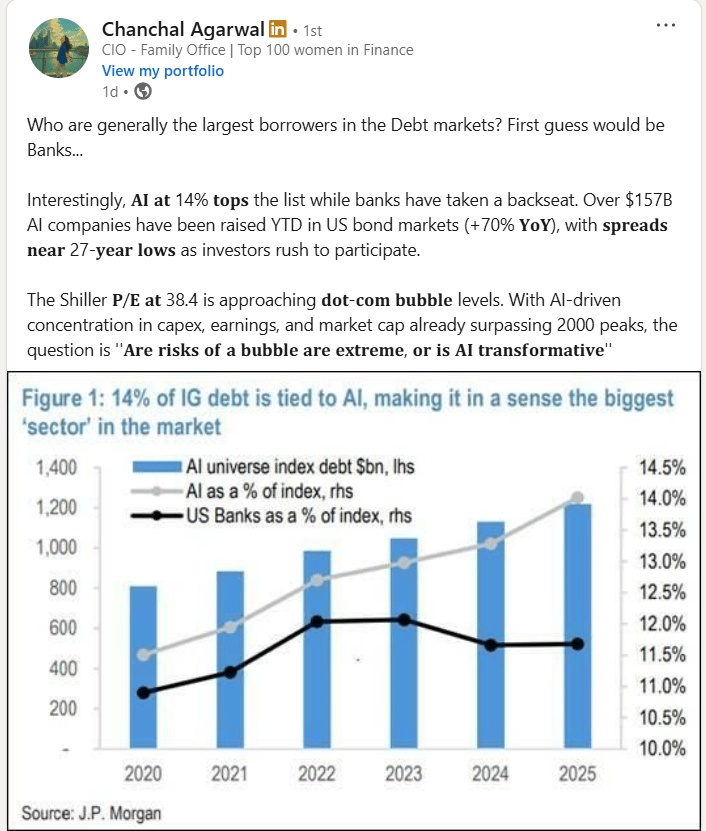

2. HCLTech prints steady Q2; dividend continues

DALL-E

Financial performance: Revenue +10.6% YoY to ₹31,942 cr, profit flat ₹4,235 cr; bookings healthy; guidance retained.

Operational lens: ER&D momentum and deal ramp-ups offset margin pressure; ₹12/share interim dividend marks the 91st consecutive payout.

Market impact: IT stayed weak amid global risk-off; HCLTech ended marginally lower.

HCLTech Q2 steady with dividend. How do you play IT here?

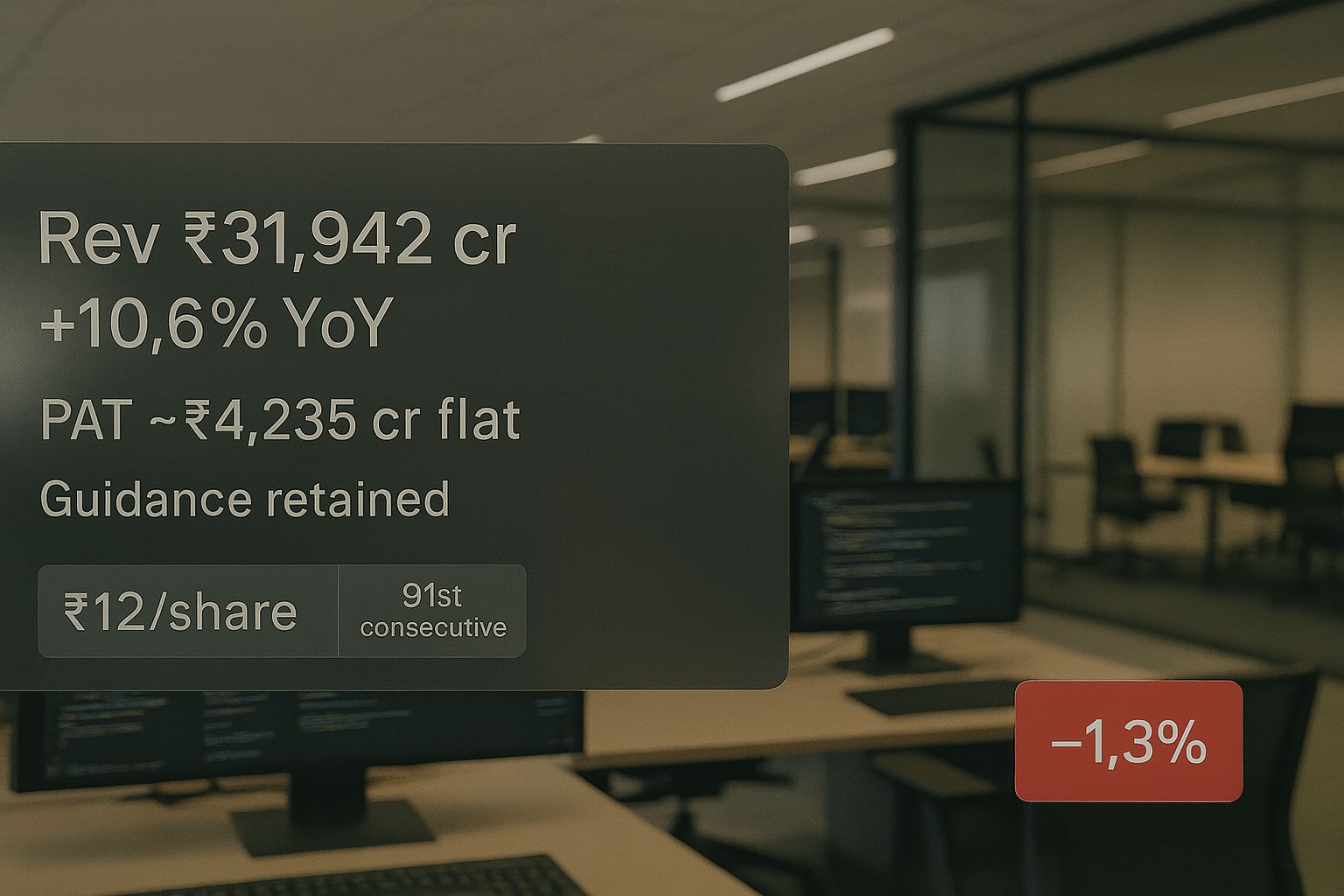

3. BLS International slumps on 2-year tender bar

DALL-E

Regulatory setback: MEA barred the visa-services firm from new government tenders for two years, triggering its worst day since 2020.

Business risk: Tender pipeline visibility dims; higher client-concentration and renewal risk come into focus.

Market reaction: Stock plunged ~13%, erasing recent gains.

BLS International barred from new govt tenders for 2 years. Your move?

4. Waaree Renewable soars on record Q2

DALL-E

Earnings growth: Net profit ~₹116 cr, >2x YoY with record revenue on robust project execution and order book.

Strategic angle: Clean-energy demand and segment expansion (incl. storage) support forward visibility.

Market reaction: Shares jumped 8-13%, nearing 52-week highs.

Waaree Renewable posts record Q2, stock pops. What’s the call?

5. DMart: decent topline, softer margins; stock slips

DALL-E

Financial performance: Q2 PAT ~₹685 cr (+4% YoY); revenue +15% YoY on steady store additions.

Operational highlights: Margin pressure and a calibrated DMart Ready footprint kept profitability in check.

Market reaction: Shares fell 2-3% as mixed broker takes outweighed growth.

DMart Q2 solid sales, softer margins. Positioning?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.