TLDR

Market Recap: November 18, 2025

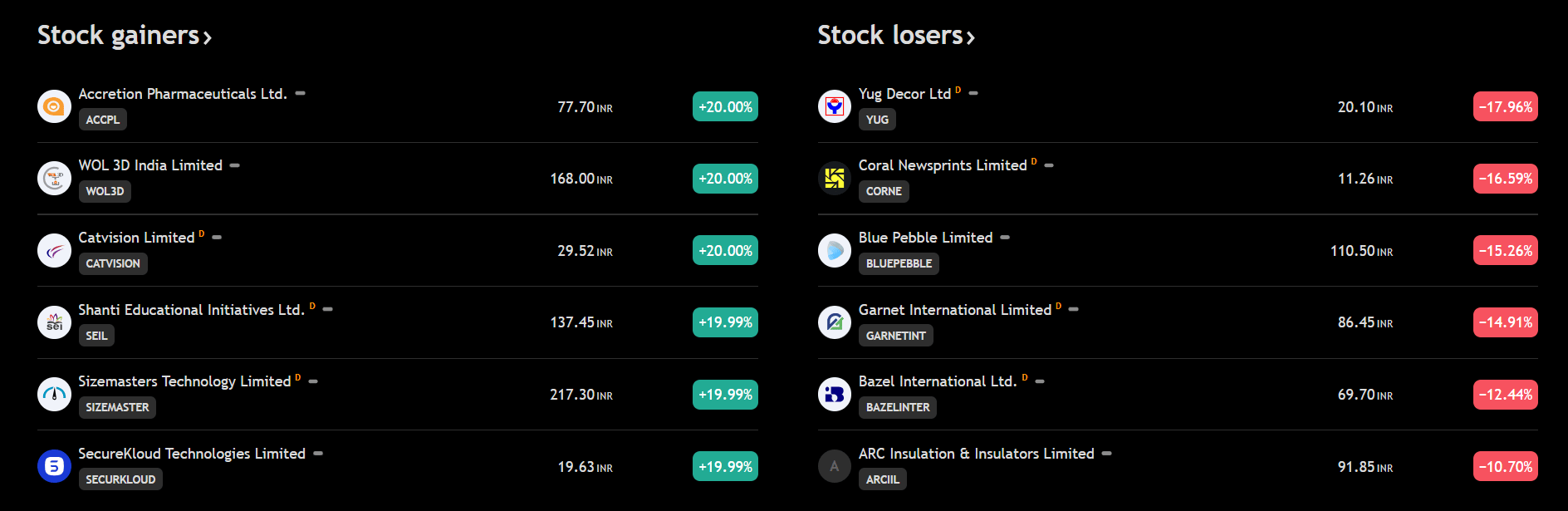

On November 18, Indian equities snapped a six‑day rise as profit‑taking hit into the close, with weak global cues and weekly expiry dynamics weighing on risk. Sensex closed 84,673.02 (-277.93, -0.33%) and Nifty 50 25,910.05 (-103.40, -0.40%). Midcaps and smallcaps lagged, Nifty Midcap 100 60,822 (-0.59%) and Nifty Smallcap 100 18,154.75 (-1.05%). Volatility firmed, India VIX 12.10 (+2.6%). Provisional flows showed FII -₹728.8 cr and DII +₹6,156.8 cr in cash. IT, realty, and metals led sectoral drags while sentiment stayed cautious ahead of key US data.

Key Drivers :

Global risk tone softens: Asian and US markets eased on valuation worries and data risk, curbing appetite for beta in India.

Flows bifurcated: FIIs remained net sellers while DIIs absorbed supply, tempering downside in benchmarks.

Sector rotation: IT and metals slipped on external cues and dollar strength, reversing part of recent outperformance; all 16 major sectors ended lower.

Today’s Top Stories:

PhysicsWallah surges on debut: Edtech IPO jumps, reviving risk appetite for scaled hybrids.

Emmvee lists flat: Solar maker sees steady debut amid selective renewables bids.

Tata Motors PV pressured: JLR margin reset keeps stock under a cloud near term.

Azad Engineering wins P&WC deal: Long‑term components pact boosts aero visibility.

Max Healthcare grinds higher: Strong Q2 and capex roadmap sustain re‑rating case.

TOP STORIES

1. PhysicsWallah pops on debut, signals edtech risk appetite

Gemini-2.5

Listing performance: Shares rose as much as 48.6% versus the issue price, implying about $5.2 bn valuation on the debut day.

Strategic angle: First edtech IPO post sector shake‑out highlights investor willingness to fund scale players with hybrid models and improving unit economics.

Market impact: Momentum spillover supported select recent listings even as broader indices eased intraday.

Your take on PhysicsWallah’s day‑one surge?

2. Emmvee Photovoltaic lists flat, price discovery steady after strong subscription

Gemini-2.5

Listing performance: Stock listed near issue price with muted premium, indicating balanced demand‑supply at open.

Strategic angle: Solar manufacturing tailwinds persist, but investors are filtering for execution visibility and order‑book quality before re‑rating.

Market impact: Limited read‑through to broader renewables pack on day one, with price action tracking market tone.

Flat debut for Emmvee - how do you see near‑term performance?

3. Tata Motors PV under pressure as JLR trims FY26 margin outlook

Gemini-2.5

Financial development: Post results, JLR cut FY26 EBIT margin guide to 0%-2% amid a September cyber incident and softer China mix; TMPV reported a headline profit boosted by one‑off demerger gain while core operations were softer.

Strategic angle: Near‑term cash‑flow focus and model refresh cycle are pivotal while BEV transition and China dynamics keep uncertainty elevated.

Market impact: TMPV shares extended weakness after Monday’s sharp fall; Tata Motors also drifted lower today.

TMPV under pressure after JLR margin reset - your stance?

4. Azad Engineering inks Pratt & Whitney Canada long‑term parts pact

Gemini-2.5

Deal contours: Azad Engineering signed a long‑term agreement to develop and manufacture aircraft engine components for Pratt & Whitney Canada; value undisclosed.

Strategic angle: Deepens aero supply‑chain credentials, potentially improving multi‑year revenue visibility and margin mix via higher value-added machining.

Market impact: The stock outperformed its peers intraday due to execution optionality and marquee OEM validation.

Long‑term aero parts pact -what’s the read‑through?

5. Max Healthcare edges higher on earnings momentum and capacity plans

Gemini-2.5

Financial development: Q2 FY26 PAT up 59% YoY to ₹554 cr with 21% revenue growth; operating metrics supported by mix and international patient growth.

Strategic angle: A multi-year expansion pipeline with disciplined funding underpins bed additions without balance-sheet strain, aiding the ROCE trajectory.

Market impact: Shares rose 2% intraday on brokerage optimism and post‑result follow‑through

Earnings momentum plus capacity build‑out position now?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.