TLDR

Market Recap: December 17, 2025

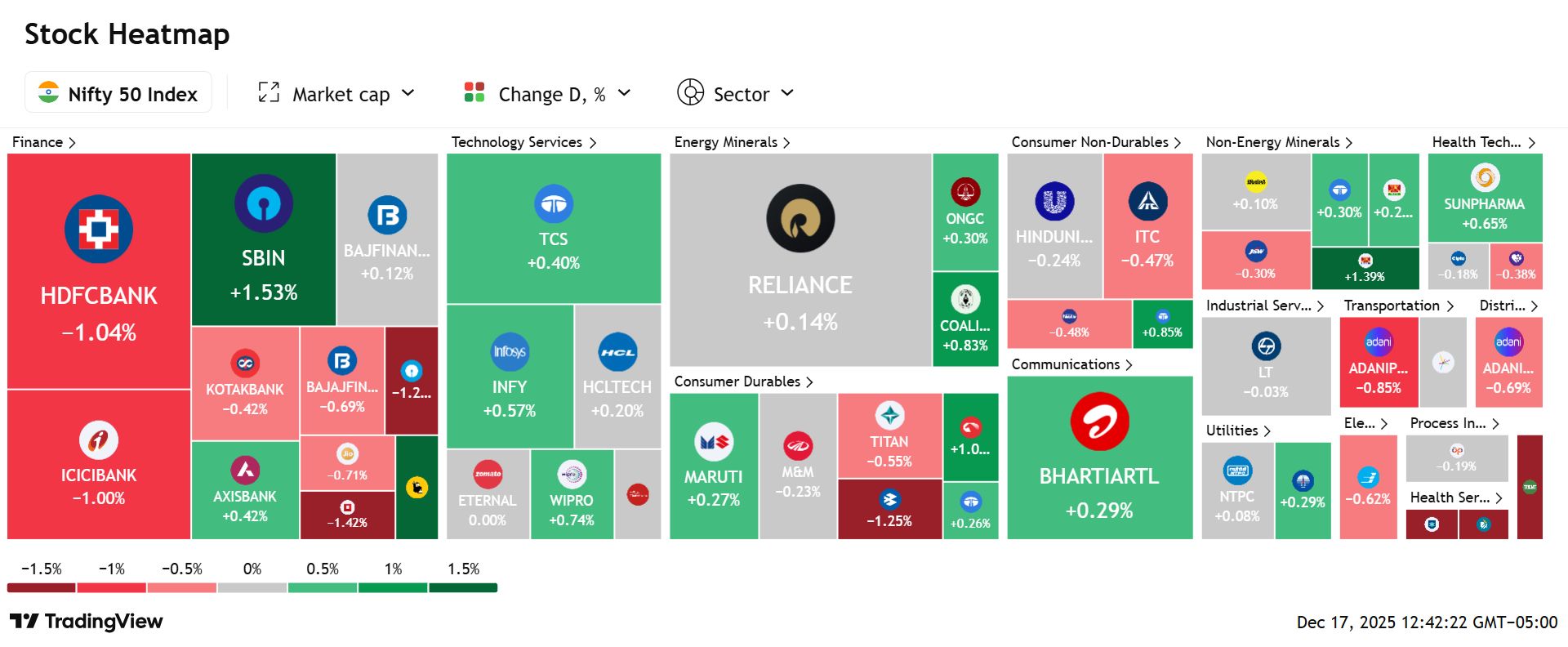

On December 17, Indian equities slipped for a third consecutive session, with banks dragging while PSU banks held up better; the rupee's movements and ongoing foreign outflow worries kept risk appetite muted. Sensex closed at 84,559.65 (down 120.21, -0.14%) and Nifty 50 at 25,818.55 (down 41.55, -0.16%); Nifty Midcap 100 fell about 0.5% and Nifty Smallcap 100 about 0.7%. India VIX eased to 9.84 (about -2.19%), while cash flows were supportive with FII +₹1,171.71 crore and DII +₹768.94 crore; the rupee ended firmer at 90.37/$ vs 91.03/$.

Key Drivers :

FX and RBI optics: RBI dollar selling talk and rupee stabilization stayed center stage after the prior session’s breach of 91.

Foreign flow overhang: Despite today’s net buying, FPIs have been sellers across recent sessions, keeping sentiment capped.

Breadth weak, pockets firm: Most sectors ended lower; PSU banks outperformed while broader mid and smallcaps lagged.

Today’s Top Stories:

MUFG + Shriram Finance: MUFG is said to deploy $4B+ for about 20%, boosting confidence in retail credit funding.

Meesho: UBS Buy initiation sparked a 20% upper circuit and extended the post-IPO momentum.

IOB: OFS at ₹34 floor hit the stock, with shares sliding on discounted supply.

Akzo Nobel India: Promoter block sale drove a sharp mid-teen drawdown amid heavy volume.

IGL: Nomura upgrade and higher target powered a roughly 5% jump despite weak benchmarks.

TOP STORIES

1. MUFG lines up $4B+ for about 20% in Shriram Finance

Gemini-2.5

Deal terms: MUFG is said to invest over $4 billion for roughly a 20% stake, with the deal expected to close soon. This would be one of the largest recent foreign bets in Indian retail credit.

Why it matters: A deep-pocketed strategic partner can lower funding costs and widen distribution for Shriram’s secured lending franchise. It also signals continued global appetite for Indian financials.

Market impact: Shriram Finance outperformed on the day, finishing among Nifty gainers.

MUFG is said to be evaluating a big minority stake in Shriram via primary issuance. Your take?

2. Meesho hits 20% upper circuit after UBS starts coverage with Buy

Gemini-2.5

Trigger: Meesho surged and locked at the upper circuit after UBS initiated with a Buy call. The rally has taken the stock to nearly double its IPO price.

Why it matters: Fresh sell-side coverage can pull in incremental institutional demand and tighten the “new listing” risk discount. It also reframes the growth narrative for Indian e-commerce.

Market impact: The stock’s sharp move made it one of the day’s standout gainers and boosted the market cap sharply.

Meesho hit an upper circuit after a fresh UBS Buy call. Does this rally sustain?

3. Indian Overseas Bank tumbles as OFS opens at about 7% discount

Gemini-2.5

What happened: The government’s OFS opened with a floor price of ₹34, framed as about a 7% discount to prevailing levels. The sale targets up to a 3% divestment.

Why it matters: PSU bank float increases can improve liquidity and index eligibility optics, but discounted supply typically pressures near-term price. It is also a signal on the broader PSU bank divestment pipeline.

Market impact: IOB fell as much as about 4% intraday after the OFS opened.

Govt OFS in IOB opened with a discounted floor price. How do you view it?

4. Akzo Nobel India slides hard after promoter stake sale via block deals

Gemini-2.5

What happened: Reports indicated promoter Imperial Chemical Industries likely offloaded a large block (reported near a 9% stake). Heavy volume hit the tape early.

Why it matters: Large promoter sell-downs can reset the supply-demand balance and spark rerating questions until new long-only holders are visible. It also shifts the free-float profile meaningfully.

Market impact: The stock dropped around the mid-teens intraday, among the day’s sharpest large-cap cuts.

Akzo dropped after a large promoter block deal. What’s the play now?

5. Indraprastha Gas jumps after Nomura upgrade to Buy

Gemini-2.5

Broker call: Nomura upgraded IGL to Buy from Neutral and raised its target to ₹230 (from ₹215), citing valuation comfort and margin tailwinds from softer gas prices.

Why it matters: City gas distributors are highly sensitive to gas input costs and regulation; upgrades here typically reflect improving margin visibility. That can reopen positioning after corrections.

Market impact: IGL rallied about 5% on the day, outperforming a soft tape.

IGL popped after a broker upgrade citing margin tailwinds. What next?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.