TLDR

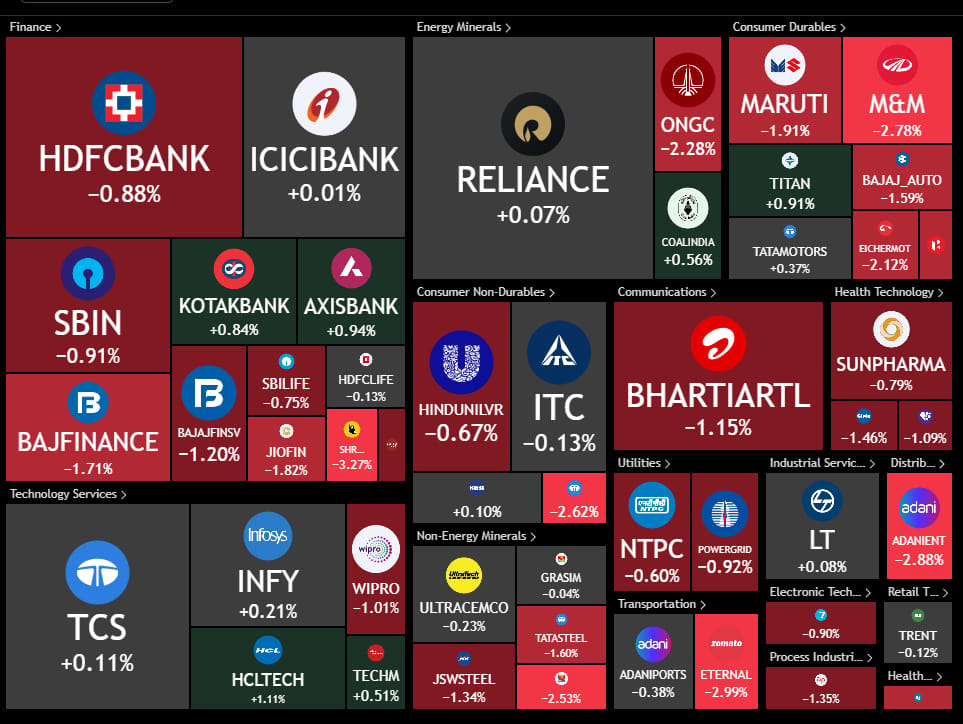

Indian financial markets are navigating a cautious landscape with geopolitical tensions from Operation Sindoor lingering, yet selective corporate developments signal resilience. FII inflows and strategic corporate moves provide some optimism, though global trade uncertainties and regional conflicts remain key concerns for investors.

Asian Paints Q4 Profit Drops 45% Amid Demand Slowdown: Asian Paints reported a 45% drop in Q4 net profit to ₹692 crore, hit by weak demand and rising input costs.

L&T Q4 Preview Signals Strong Revenue Growth: Larsen & Toubro (L&T) is expected to report revenue and profit growth in Q4, driven by robust order inflows in infrastructure.

RBI Signals Rate Hold Amid Inflation Concerns: The RBI indicated it will likely hold interest rates steady, citing inflation risks from geopolitical tensions and global trade shifts.

Reliance Retail Expands with Quick Commerce Push: Reliance Retail launched 10 new quick commerce centers across India, aiming for same-day delivery to rival local startups.

HDFC Bank Q4 Profit Rises 10% Amid Strong Loan Growth: HDFC Bank reported a 10% Q4 profit increase to ₹16,512 crore, driven by robust loan growth and stable asset quality.

TOP STORIES

1. Asian Paints Q4 Profit Drops 45% Amid Demand Slowdown

DALL-E

Asian Paints’ Q4 net profit fell 45% to ₹692 crore, impacted by sluggish demand and higher input costs, despite a ₹20.55 per share dividend announcement.

The company faces challenges from a cooling housing market, which may continue to weigh on its performance in the near term.

Investors might consider diversifying into other consumer discretionary stocks with stronger demand trends, while tracking Asian Paints’ cost management strategies.

2. L&T Q4 Preview Signals Strong Revenue Growth

Larsen & Toubro (L&T) is projected to report revenue and profit growth in Q4, driven by strong order inflows in infrastructure and construction.

The company’s robust order book suggests resilience amid economic uncertainties, making it a potential safe bet in the infrastructure sector.

Investors should assess L&T’s project execution and margin trends, as infrastructure spending could drive long-term growth.

3. RBI Signals Rate Hold Amid Inflation Concerns

The RBI plans to maintain steady interest rates, citing inflation risks from geopolitical tensions and global trade disruptions, as per recent economic reports.

A rate hold could stabilize borrowing costs for companies but may pressure sectors like real estate that rely on rate cuts for growth.

Investors should focus on inflation-resistant sectors like FMCG and utilities, while monitoring RBI’s future guidance on rate adjustments.

4. Reliance Retail Expands with Quick Commerce Push

Reliance Retail opened 10 new quick commerce centers across India, focusing on same-day delivery to compete with players like Blinkit and Zepto.

This expansion taps into the growing e-commerce trend, potentially boosting Reliance Retail’s market share in urban centers.

Investors should watch for operational efficiency and consumer adoption rates, as quick commerce could drive significant revenue growth for Reliance.

5. HDFC Bank Q4 Profit Rises 10% Amid Strong Loan Growth

HDFC Bank’s Q4 net profit grew 10% to ₹16,512 crore, fueled by strong loan growth and stable asset quality, as reported on May 7, 2025.

The bank’s focus on retail and SME lending could support steady growth, making it a reliable pick in the banking sector.

Investors should monitor HDFC Bank’s net interest margins and digital banking initiatives for sustained profitability.

INDIASTOX HACKATHON

Submissions Due: May 27, 2025

Contact: [email protected]

Submit your original analysis of a pre-IPO company to compete for cash prizes and recognition. Your submission will be reviewed by IndiaStox expert judges on originality, clarity, and conviction. Showcase your talent and get paid for it!

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission—whether in whole or in part—across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.