TLDR

Market Recap: November 24, 2025

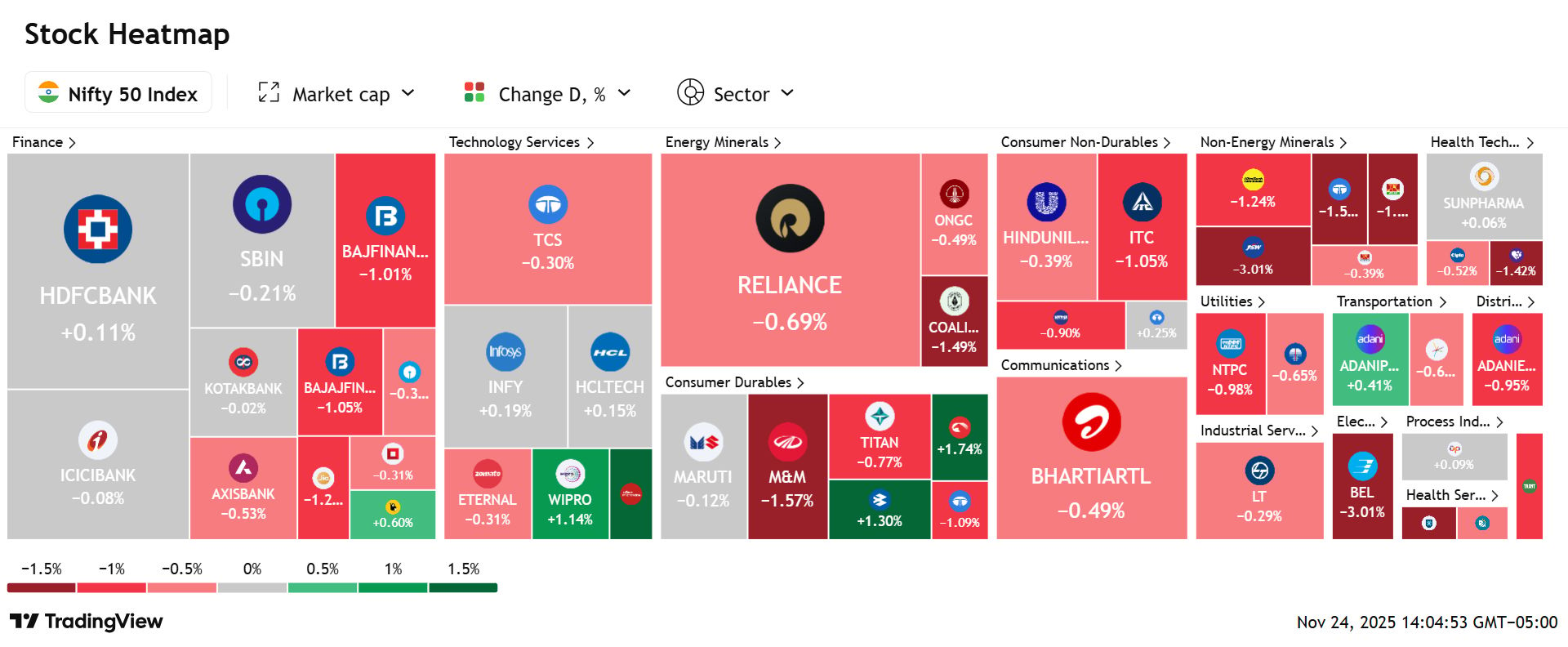

On November 24, Indian equities slipped on profit booking and mixed global cues. Sensex closed at 84,900.7 (-331 pts, -0.39%), Nifty 50 at 25,959.5 (-108.7 pts, -0.42%). Midcap and Smallcap 100 underperformed, and India VIX edged up, signaling slightly higher near-term caution. FIIs sold, DIIs broadly offset the outflows.

Key Drivers :

Flows: FIIs were net sellers, DIIs bought, keeping headline indices orderly despite weak breadth.

Global setup: Cautious tone ahead of key US data and Fed commentary capped risk appetite.

Sectors: Realty, metals, and consumer names lagged; select infra and PSU stocks outperformed on order news.

Today’s Top Stories:

TCS: US court keeps 194 million dollar damages in the DXC case, adding legal noise but not balance sheet stress.

Dilip Buildcon: Wins NALCO’s ₹5,000 crore Pottangi MDO mandate, boosting long-duration mining order visibility.

Tata Chemicals: Okays ₹910 crore expansion in soda ash and silica, but rich valuations cap share gains.

NBCC: Adds ₹116.95 crore of fresh PSU orders, supporting growth and lifting the stock.

Natco Pharma: The Manali API site receives seven USFDA observations, causing the stock to decline on regulatory concerns.

TOP STORIES

1. TCS hit with 194 million dollar US damages

Gemini-2.5

Financial impact: The US court upheld about 194 million dollars in trade secret damages in the DXC dispute.

Strategic view: Creates a legal overhang in the US, but is manageable versus TCS cash and earnings.

Stock move: Share slipped marginally, reflecting limited concern about balance sheet stress.

TCS faces 194 million dollar US damages in DXC case. How big is this risk?

2. Dilip Buildcon bags ₹5,000 crore NALCO MDO project

Gemini-2.5

Deal size: Named the lowest bidder for NALCO’s ₹5,000 crore Pottangi bauxite mine and conveyor project in Odisha.

Business impact: Deepens long tenure mining exposure and diversifies beyond roads into MDO contracts.

Stock move: Shares gained around 3 to 4 percent on stronger long-term order book visibility.

Dilip Buildcon wins NALCO 5,000 crore Pottangi mine MDO. How do you see it?

3. Tata Chemicals clears ₹910 crore capex

Gemini-2.5

Capex plan: Board approved ₹910 crore to expand soda ash at Mithapur and silica at Cuddalore.

Strategic logic: Positions the firm for demand in glass, detergents, and specialty silica for tyres and EVs.

Stock move: After an early pop, the stock ended slightly lower as investors weighed high valuations.

Tata Chemicals okays 910 crore soda ash and silica capex. Your view?

4. NBCC wins ₹116.95 crore in new government work

Gemini-2.5

Order details: Announced ₹116.95 crore of projects from NIEPMD, National Horticulture Board, and Canara Bank.

Business impact: Reinforces NBCC’s niche in government-led social and infrastructure projects with repeat clients.

Stock move: Shares rose about 3 to 4 percent, extending recent strength in PSU contractors.

NBCC adds 116.95 crore in new PSU orders. Is the PSU rally still attractive?

5. Natco Pharma gets seven USFDA observations

Gemini-2.5

Inspection outcome: USFDA issued seven Form 483 observations after inspecting the Manali API facility.

Regulatory impact: The Company calls them procedural, but remediation quality will decide any escalation risk.

Stock move: The Stock fell nearly 3 percent as the market priced in compliance overhang.

Natco Pharma gets seven USFDA observations at its Manali API plant. Your take?

Disclaimer:

The IndiaStox Research Hackathon is intended for educational and community engagement purposes only. Submissions do not constitute investment advice, nor should they be construed as recommendations to buy or sell any securities.

By participating in the IndiaStox Research Hackathon and submitting content, you grant IndiaStox a worldwide, royalty-free, perpetual, and irrevocable license to use, reproduce, modify, publish, distribute, and display your submission, whether in whole or in part, across its digital platforms and in promotional materials. This license extends to both commercial and non-commercial purposes, including content seeding, editorial use, and advertising.

By submitting your work, you confirm that it is your original creation and that you have the right to grant the above license.